Backdoor Roth IRA in Simple Steps

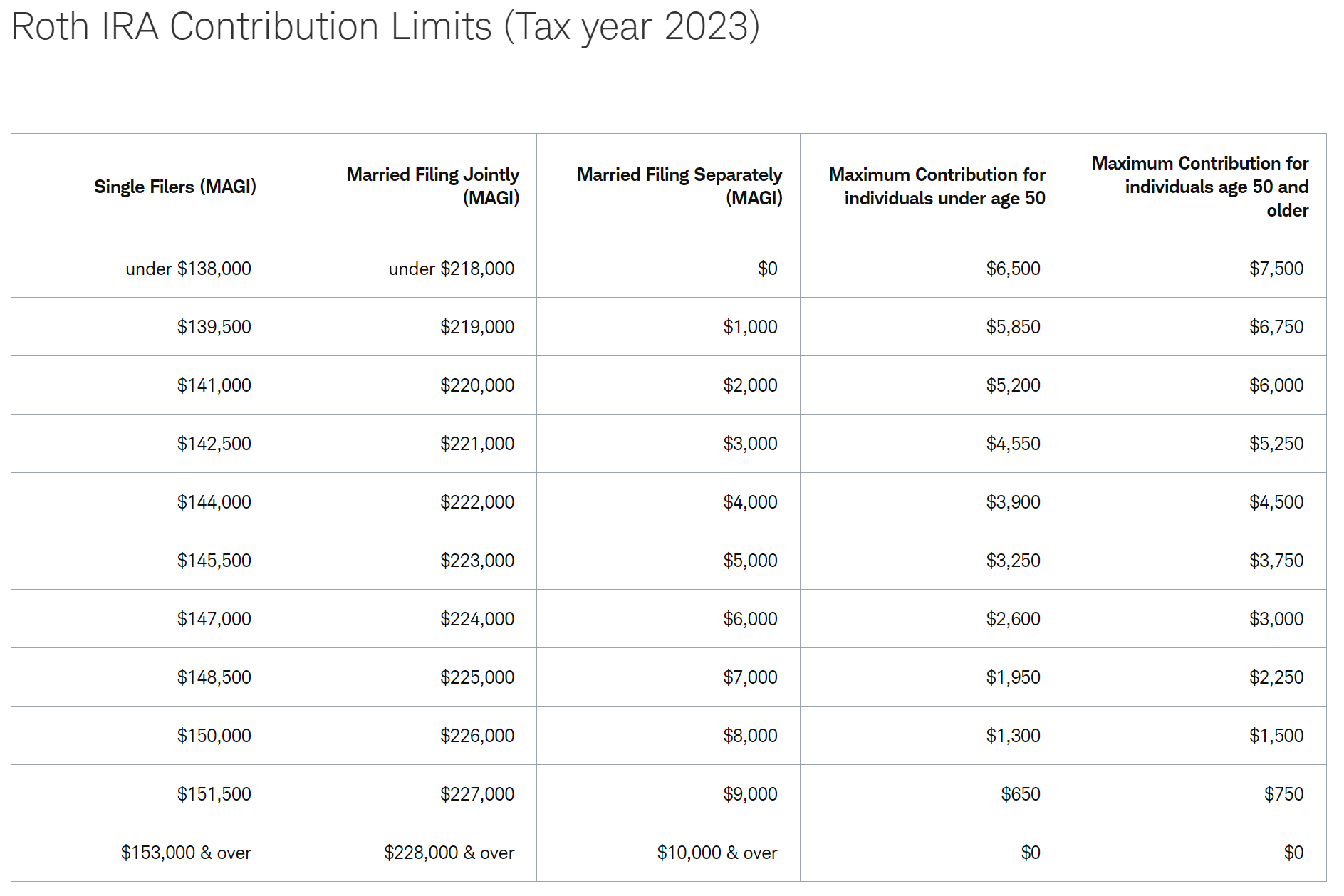

If you are a high income earner, it is very likely you will NOT be able to contribute the max possible contribution for a Roth IRA. Because Roth IRAs have such a powerful tax advantage (i.e. tax-free withdrawal after retirement), the IRS restricts Roth IRA contributions based on your income level. Your max contribution limit for a Roth IRA will decrease as your income level increases and can even reach $0 if you make too much income. See the table below for how your income level affects your max contribution limit.

Bypassing Income Level Restrictions

While the IRS imposes income level restrictions on Roth IRA contributions, the IRS also allows a way to circumvent it. The key is to fund a Roth IRA in a way that does not count towards an actual contribution as defined by the IRS. A Roth IRA funded by these alternative means is commonly known as a Backdoor Roth IRA.

Rollovers

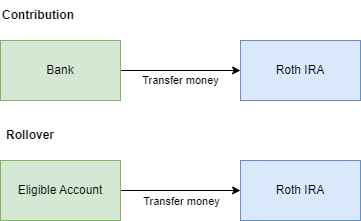

There are two ways to fund an IRA. One is transferring money from your bank or payroll (contributions) and one is from transferring money from another eligible account (rollovers). Rollovers do NOT count as contributions as defined by the IRS. You can perform rollovers with money from a Traditional IRA or qualified employer sponsored retirement plan (QRP) — such as a 401(k), 403(b), or governmental 457(b).

Roth Conversion

Whenever you do a rollover from a non-Roth account to a Roth account, the money goes through a Roth conversion. A Roth conversion is turning all the money in your account into after-tax money. If you only have after-tax money in the account, then nothing really happens. If you have any pre-tax money in the account, then you have to pay taxes on it in order for it to rollover to your Roth account. For simplicity, it is usually recommended to work with only after-tax money for doing rollovers to Roth IRAs.

How To Setup Backdoor Roth IRA

- Create a Roth IRA account

- Create a Traditional IRA account

- Contribute to your Traditional IRA account. Keep in mind the max IRA contribution limit is $6,500 for those under 50 and $7,500 for those 50 and older.

- Rollover your contributions from your Traditional IRA account to your Roth IRA account. This can be done once your contributions to your Traditional IRA settle and show up as available to withdraw. Depending on the broker you use (i.e. Fidelity, Charles Schwab, etc), you can do a rollover online or by filling a form and sending it to customer support.

Final Thoughts

Roth IRAs are a powerful financial vehicle to use for retirement. It's not clear why the IRS put an income level restriction but allows a roundabout way to fund Roth IRAs. But it's good that this option is available still for those who do not meet the income level eligibility requirements for Roth IRA contributions.

If you are looking to start a Backdoor Roth IRA, I recommend using Fidelity. I have had a pretty seamless experience backdooring on the Fidelity website. Everything can be done online--even rollovers (no physical forms needed). Feel free to use the referral here.

If you enjoyed reading this post, please consider subscribing to Pocket Finance Club to keep up with the latest financial news and tools to improve your pocket! We have a Twitter account and a Facebook page.