Best Credit Card for Utility Bills (2024)

Utility bills are something we all have to deal with in life. It's a perpetual expense for as long as we use electricity, water, waste, and other common utilities. Because of this, it might make sense to look into the best ways to get cash back for these expenses.

Most credit card users will likely default to their universal cash back card (2% cash back) for these expenses. However, there's a new card that offers even more: the US Bank Cash Plus Card.

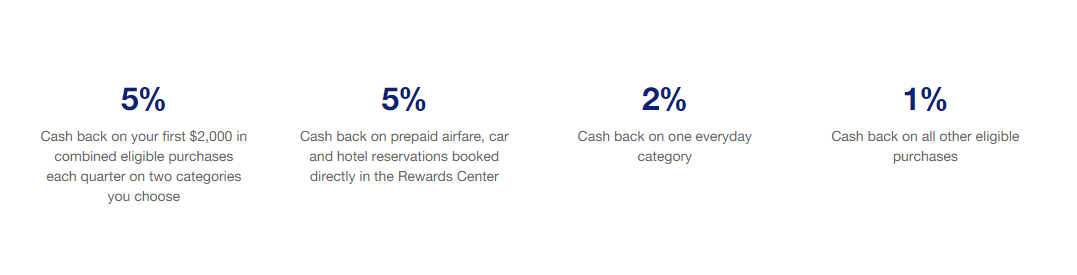

The US Bank Cash Plus Card is a category credit card that has two tiers: 5% cash back and 2% cash back. These categories are selectable every quarter for the upcoming period. Here is a high level breakdown:

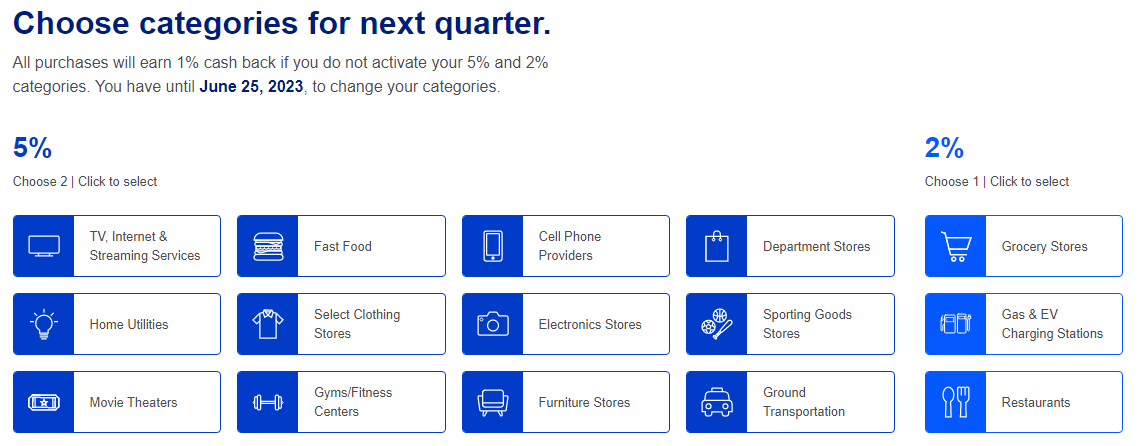

What makes the US Bank Cash Plus Card the best card for utility bills is because of its supported categories:

While most are standard categories, Home Utilities is not (in fact, this card offers a few uncommon categories such as Furniture Store). Home Utilities includes includes internet bills, electricity bills, water bills, sewage bills, waste bills and in some cases subscription bills (such as Spotify, etc).

Even if you are already using a 2% cash back card for your credit card friendly utility bills, an additional 3% will help compound your savings over time. These bills will likely never go away, so it doesn't hurt to start stacking more cash back on it!

Another advantage appreciated by many cardholders is the card's sign-up bonus (SUB). The SUB offers a substantial $200 for a minimal $1,000 spend, which is an attractive deal.

Final Thoughts

Utility bills are a common expense, making this card a valuable addition to most wallets. If you aren't already earning cash back on these payments, now's a great time to start, especially with high utility costs. However, remember to check if your utility provider charges a fee for credit card payments to ensure the cash back is worthwhile. In the credit card world, it's hard to beat 5% cash back.