Best Credit Cards with No Annual Fee for 2023

As 2023 approaches, it is important to start planning for your financial goals and identifying ways you can work towards them. One way to do this is by carefully reviewing your credit card portfolio and considering whether there are any changes you can make to improve your pocket.

At Pocket Finance Club, I understand that choosing the right credit card can be overwhelming, especially when you may be focusing on saving rather than spending in the coming year. So instead of focusing on spending, focus on optimizing. I think the best way to do that is find cards that offer advantages in items you already spend money on. That is why I have put together this list of my top credit card picks with no annual fee for 2023, organized by card type to help you find a card that aligns with your personal needs and financial goals. These are the types of credit cards you may want to consider adding to your portfolio to get more value out of your everyday spending in 2023.

Universal Cash Back Card

The card for all occasions.

A universal cash back card is a card that will give you guaranteed cash back no matter what the category is. Think of these cards as a backup card you can use in cases where you are not sure what the category is or if your other cards cannot take advantage of the category. Many of the most competitive cards in this category offer 2% cash back, making them a valuable addition to your credit card portfolio. And since most universal cash back cards have no annual fee, they are an affordable way to start earning rewards on your purchases. I recommend that everyone have at least one universal cash back card in their wallet, and I have two specific recommendations in this card type that I think are worth considering.

Wells Fargo Active Cash Card

Wells Fargo Active Cash Card

- Unlimited 2% cash back

- A welcome bonus of $200 after spending $1,000 in the first 3 months

- 0% Intro APR for 15 months on purchases and balance transfers

- Visa Signature perks

Wells Fargo Active Cash Card is my first recommendation for a universal cash back card with zero annual fees. One of the main reasons I recommend this card is because most universal cash back cards do not offer a welcome bonus. If they do, it is either a targeted promotion (e.g. Fidelity Rewards Visa Signature) or a limited promotion window (e.g. Citi Double Cash Card). Additionally, the Wells Fargo Active Cash Card has the lowest spending requirement to earn the welcome bonus among similar cards, which makes it more accessible for those who may find it difficult to spend $1000 or more in the first three months.

PayPal Cashback Mastercard

PayPal Cashback Mastercard

- Unlimited 2% cash back

- Unlimited 3% cash back if checking out with PayPal Checkout (using the PayPal Cashback Mastercard as the payment option)

- Occasional promotions for 4% cash back

- Cash back can be redeemed immediately

- World Elite Mastercard perks

While the PayPal Cashback Mastercard 2% cash back rate alone would not be enough to recommend this card, it also offers a range of additional perks that make it stand out. Some of the additional perks that may make the PayPal Cashback Mastercard a better choice than the Wells Fargo Active Cash Card includes the additional 1% cash back for using PayPal Checkout and the immediate cash back redemption. For most cards, you have to wait for the billing cycle to end to get cash back rewards, but in this case, you can start moving those rewards to your bank the day of your purchase.

Top Spend Card

The card for uncommon categories.

Top spend cards are a type of credit card that rewards cash back based on your highest spending category at the end of the billing cycle. This card type is relatively new, so there are not many options to choose from yet. However, one thing that all top spend cards seem to have in common is that they typically have no annual fees. These cards are unique in that they allow you to earn rewards on all spending categories, not just a select few that rotate on a quarterly basis like some other cards (e.g. the Chase Freedom Flex Card). The best way to use these cards is to target one single category for it. By using one of these cards for your targeted category, you can maximize your rewards and get some of the best cash back rates available. Here is my top recommendations for top spend cards:

Citi Custom Cash Card

Citi Custom Cash Card

- 5% cash back on highest spend category each billing cycle up to $500 spent and then 1% cashback thereafter on all other purchases

- A welcome bonus of $200 after spending $1,500 in the first 6 months

- 0% Intro APR for 15 months on purchases and balance transfers

- World Elite Mastercard perks

Citi Custom Cash Card provides one of the most competitive cash back rates at 5% for any category that ends up being your highest spending category for the billing cycle. The $500 spend limit is a good fit for categories of expenses that you already budget for at $500 or less. When using this card, it's a good idea to think about categories where you do not normally get 5% cash back on, such as restaurants, home improvement stores, and travel. The card also comes with a generous welcome bonus of $200, and Citi gives you six months to meet the spending requirement to earn it. Overall this card is an excellent addition to your credit card portfolio.

Venmo Credit Card

Venmo Credit Card

- 3% cash back on top spend category

- 2% cash back on second top spend category

- 1% cash back on everything else

- Visa Signature perks

Next on my list is the Venmo Credit Card. While it offers a lower cash back rate of 3% compared to the Citi Custom Cash Card, it does come with some unique advantages. First, it doesn't have a per-billing-cycle spend limit like the Citi Custom Cash Card. Instead, it has an annual limit of $10,000, after which purchases only earn 1% cash back. Second, the Venmo Credit Card has a category that is not commonly found on cash back cards called Bills and Utilities, which includes purchases for your electricity bill, water bill, waste management, and streaming services. This category alone makes the card worth considering for those who want to earn 3% cash back on these types of expenses. For everything else, you might be better off with a universal cash back card.

Targeted Category Cards

The card for specific spending habits.

Targeted category cards are by far one of the most common credit card types that offer some of the highest cash back rates. These cards provide 3% or more cash back on specific categories of purchases, and some even rotate their categories quarterly, allowing you to earn rewards on different categories every three months. I have three recommendations for targeted category cards, but the value of these cards will depend on your specific spending habits.

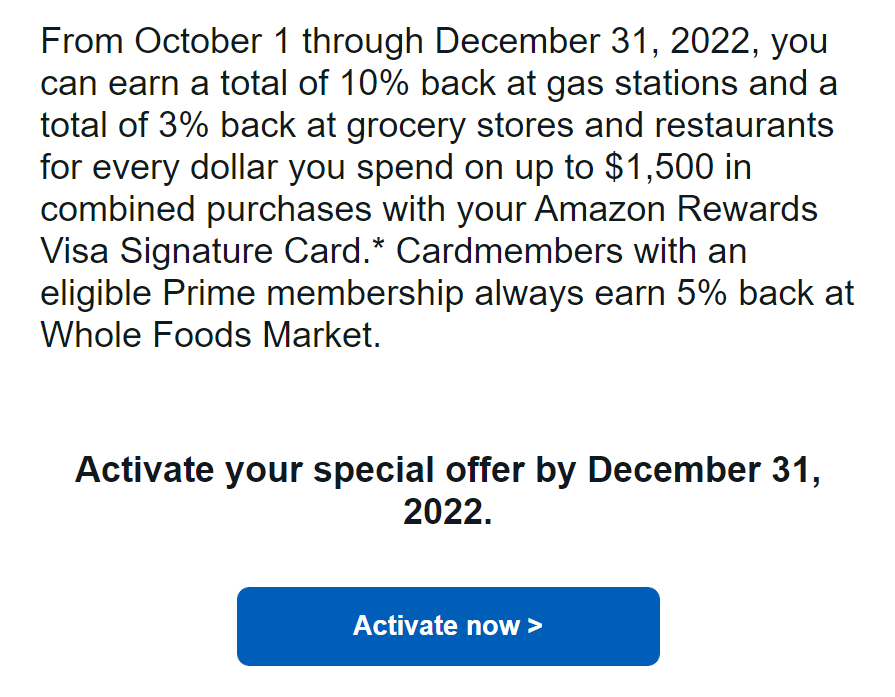

Amazon Prime Rewards Visa Card

Amazon Prime Rewards Visa Card

- 5% cash back on Amazon.com and Amazon physical stores (Prime membership required)

- 5% cash back at Whole Foods Market (Prime membership required)

- 2% cash back at restaurants and gas stations

- 1% cash back on all other purchases

- Occasional 10% cash back promotions on items and categories on Amazon.com (Prime membership required)

- $150 Amazon Gift Card welcome bonus (limited time promotion)

- Visa Signature perks

The Amazon Prime Rewards Visa Card is an excellent choice for Prime members who already shop on Amazon.com or Whole Foods. This card also comes with limited-time offers where cardholders can earn 10% cash back on certain items and categories on Amazon.com. Recently, they have also included limited-time offers for purchases on not related to Amazon.com such as gas.

If you are a frequent shopper on Amazon.com and want to earn rewards on your purchases, this card is a must have.

Amex Blue Cash Everyday Card

Amex Blue Cash Everyday Card

- 3% cash back on groceries on up to $6,000 per year in purchases (then 1%)

- 3% cash back on U.S. online retail purchases on up to $6,000 per year (then 1%)

- 3% cash back on gas at U.S. gas stations on up to $6,000 per year in purchases (then 1%)

- Amex offers (industry leading purchase promotions)

- 0% Intro APR for 15 months on purchases and balance transfers

The Amex Blue Cash Everyday Card is best for a lot of every day activities (thus the name) such as groceries, gas, and online shopping. You will also gain access to Amex Offers, which are exclusive, limited-time promotional deals from well-known brands that can include discounts on hotels, luxury brands, sporting goods, and more. While the cash back rate on the Amex Blue Cash Everyday Card is a bit lower than other targeted category cards at 3%, the categories that earn this rate are highly valued and available throughout the entire year and combining that with Amex offers can often bring you above a 5% cash back return.

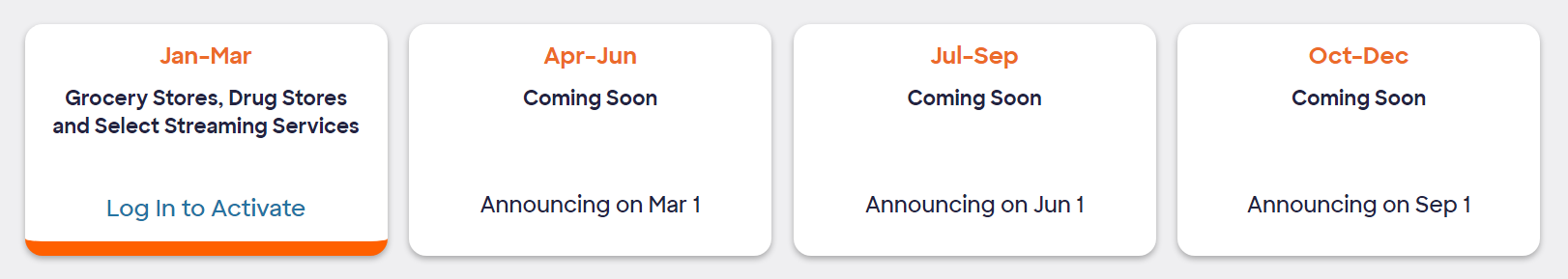

Discover it Cash Back Credit Card

Discover it Cash Back Credit Card

- 5% cash back on rotating categories (Amazon.com, grocery stores, restaurants, gas stations, etc) on up to $1,500 in purchases per quarter (then 1%)

- 1% cash back on all other purchases

- Unlimited cash back match for first year

The Discover it Cash Back Credit Card is a good option for those who are more actively involved in using their credit card and can take advantage of the quarterly category rotations. This card offers 5% cash back on select categories, which are listed on the calendar on Discover's website.

While this card is comparable to the Chase Freedom Flex Card (also a rotational targeted category card), it does offer a welcome bonus that puts it farther ahead in terms of rewards. Discover has a unique welcome bonus called the Cashback Match. With Cashback Match, you can get an unlimited dollar-for-dollar match of all the cash back you have earned at the end of your first year.

What's In My Pocket for 2023

The cards recommended in this list are all strong contenders, and the key factor I wanted to emphasize is that they all have zero annual fees, so you can use them at no cost to you. Everyone has different needs and spending habits, so it is important to choose the card that best suits your lifestyle. For me personally, my pocket consists of the following:

- Citi Custom Cash Card for restaurants (5% cash back)

- Amex Blue Cash Everyday Card for groceries, gas, and online shopping (3% cash back)

- Venmo Credit Card for bills and utilities (3% cash back)

- PayPal Cashback Mastercard for everything else (2-3% cash back)

- Amazon Prime Rewards Visa Card (5% for Amazon.com orders)

- Discover it Cash Back Credit Card (5% cash back if the category is convenient)

I will go over my full credit card portfolio (yes, there's more!) in another post but I hope this helps offers some ideas for the new year.

If you enjoyed reading this post, please consider subscribing to Pocket Finance Club to keep up with the latest financial news and tools to improve your pocket. Also, we now have a Twitter account and a Facebook page.

Thank you again for stopping by and Happy New Year!