Certificates of Deposit Explained: What Every Investor Should Know

Navigating the world of savings can be something like trying to pick the best pastry at a horribly over-stocked French bakery: they all look absolutely delicious, but kinda, you just don't know what you should take. Today, we carve into another classic choice: the Certificate of Deposit (CD), a financial product as plain as a croissant but offering a little more dough in the end.

Understanding Certificates of Deposit: Terms, Insurance, and Early Withdrawal Penalties

Certificates of Deposit (CDs) are a staple of conservative investment strategies, offering a fixed interest rate over a specified term. They are particularly appealing for those looking to park their money in a low-risk vehicle. However, understanding the nuances of CDs, including their terms, insurance coverage, and the implications of early withdrawal, is essential for making informed decisions.

CD Terms

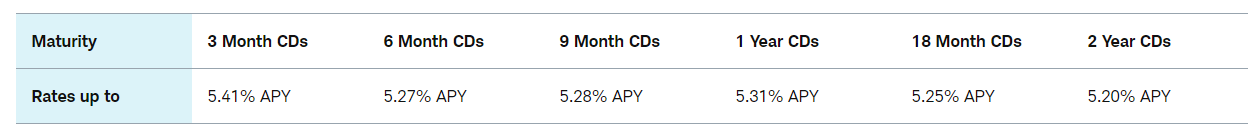

The "term" of a CD refers to the length of time your money is deposited for, during which it earns interest. Typically, CD terms can range from as short as one month to as long as ten years, with the interest rate usually increasing with the length of the term. Common terms for CDs include 3 months, 6 months, 1 year, 18 months, 2 years, and 5 years, among others. The right term for you depends on your financial goals and liquidity needs.

FDIC Insurance

One of the key benefits of CDs, especially when issued by banks, is that they are FDIC insured. The Federal Deposit Insurance Corporation (FDIC) protects depositors against the loss of their deposits if an FDIC-insured bank or savings association fails. FDIC insurance covers up to $250,000 per depositor, per insured bank, for each account ownership category. This insurance makes CDs an even safer investment, providing peace of mind to depositors.

Early Withdrawal Penalties

While CDs are intended to be held until the end of the term, life sometimes requires flexibility. Most CDs allow for early withdrawal, but this comes at a cost. The penalty for withdrawing funds from a CD before its maturity date varies by institution and the length of the CD term. Typically, the penalty might be several months' worth of interest for shorter-term CDs and up to a year or more of interest for CDs with longer terms.

For example, withdrawing early from a 1-year CD might cost you three months' interest, whereas early withdrawal from a 5-year CD might cost you six months' interest or more. These penalties can significantly eat into the interest earned, and in some cases, you might even lose some of the principal. Therefore, it's crucial to consider your liquidity needs before locking in a CD.

CDs vs. High-Yield Savings Accounts

When comparing Certificates of Deposit (CDs) to high-yield savings accounts, the primary considerations revolve around the balance between earning potential and liquidity. CDs typically offer higher interest rates than high-yield savings accounts, making them appealing for investors willing to lock in their money for a fixed term. This commitment to a term allows banks to offer a higher rate, as they have the assurance that the funds will remain deposited for a specific period.

On the other hand, high-yield savings accounts provide a significant advantage in terms of flexibility and access to funds. Unlike CDs, which impose penalties for early withdrawal, high-yield savings accounts allow you to withdraw money at any time without incurring fees. This feature makes them an excellent option for individuals who seek higher returns than those offered by standard savings accounts but still need the assurance that they can access their funds without penalties if necessary.

CDs vs. Treasuries

In the comparison between Certificates of Deposit (CDs) and Treasury securities, both investment options offer structured maturities and predictable interest payments, appealing to those seeking stability and safety in their investment choices. The primary distinction lies in their backing and the interest rates they offer.

CDs are bank-issued and protected by the Federal Deposit Insurance Corporation (FDIC) up to certain limits, offering a layer of security to investors. They often provide higher interest rates, especially for longer-term investments, as banks incentivize customers for locking in their funds for extended periods. This potential for higher yield makes CDs attractive to investors willing to commit their money for a fixed term to maximize returns.

On the other hand, Treasury securities are government-backed, representing loans made to the U.S. government. This backing by the full faith and credit of the U.S. government renders Treasuries among the safest investment vehicles available, virtually eliminating the risk of default. However, this supreme level of safety can sometimes come at the cost of lower yields compared to CDs, particularly in longer maturities.

The choice between CDs and Treasuries often hinges on the investor's preference for yield versus safety. Investors leaning towards maximizing their returns might find CDs more appealing, particularly for longer-term investments where the interest rate differential can be more pronounced. Conversely, those prioritizing the ultimate in safety, with the assurance of the government guarantee, may opt for Treasuries, accepting potentially lower yields in exchange for the highest possible security.

Do Banks Benefit From Your CD?

Yes. Banks are not just holding your money for the goodness of the heart but are actually making that money work. Basically, the bank turns around and loans the money back out again, charging somebody else an interest rate higher than they pay you. That's the point where the banks make their money. The difference in the rate of interest—less, of course, than that made by paying less in interest than you actually earn on it; and, viola, the profit.

Navigating the Pitfalls of Rate Lock-In with Certificates of Deposit

It is important to note that one off the biggest drawbacks of investing in Certificates of Deposit (CDs) is the risk of locking in an interest rate that might become less competitive due to future rate hikes. This can lead to a situation where your money is tied up in a CD earning lower interest than new CDs or other investment vehicles available on the market. Understanding this risk and strategizing accordingly is crucial for maximizing your investment returns in a fluctuating interest rate environment.

The Challenge of Rate Lock-In

When you purchase a CD, you agree to a fixed interest rate for the duration of its term. This can be advantageous in a declining rate environment, securing you a higher return than what's available elsewhere. However, if interest rates rise, you're stuck with the lower rate, potentially missing out on higher earnings. This scenario is especially relevant in periods of economic recovery or inflation when central banks may raise interest rates to cool the economy.

Strategic Approaches to Mitigate Rate Lock-In

- Laddering Strategy: A popular method to counter the rate lock-in effect is implementing a CD laddering strategy. This involves purchasing multiple CDs with varying terms so that they mature at different times. For example, instead of investing all your money in a single 5-year CD, you could spread it across 1-year, 2-year, 3-year, 4-year, and 5-year CDs. As each CD matures, you can reinvest the funds in a new long-term CD, potentially at a higher rate. This strategy provides both liquidity and exposure to rising rates over time.

- Shorter-Term CDs: In an environment where rate hikes are anticipated, opting for shorter-term CDs can be wise. Short-term CDs allow you to reinvest at a higher rate more frequently, reducing the opportunity cost of being locked into a lower rate. However, this approach requires more active management and a closer eye on the interest rate environment.

- Callable CDs: Some investors might consider callable CDs, which typically offer a higher interest rate in exchange for the bank's option to "call" or redeem the CD before its maturity date. This can be beneficial if the bank calls the CD during a period of rising rates, as it allows you to reinvest sooner at a higher rate. However, this product carries its own set of risks, including the chance that the CD may not be called, leaving you locked in for the duration.

- Stay Informed and Flexible: Keeping abreast of economic forecasts and interest rate trends can help you make more informed decisions about when to enter or exit CD investments. Flexibility in your investment strategy, including being ready to pivot to other investment vehicles if they offer better returns, is key.

Wrapping It Up

Certificates of deposit fundamentally provide a very simple secure investment alternative for those who want to save their funds for a given period. They can be an effective way to optimize yield on cash at the cost of liquidity. When comparing CDs to high-yield savings accounts and Treasuries, the decision hinges on your need for access to your money and your risk tolerance. While CDs offer a safe and predictable investment route, the potential drawback of rate lock-in requires strategic thinking to mitigate. By employing strategies like laddering, opting for shorter terms, or considering callable CDs, investors can navigate the challenges of fluctuating interest rates more effectively. Remember, the goal is not just to secure a safe haven for your money but to ensure it grows optimally over time, adapting as the economic landscape changes.