Exploring Robinhood's 1% IRA Match

Robinhood just announced early access to Robinhood Retirement, kicking off their expansion into the retirement market.

Introducing #RobinhoodRetirement the only IRA with a 1% match. Early access 👉 https://t.co/ZGcuWn274c pic.twitter.com/i5MSDAsqyx

— Robinhood (@RobinhoodApp) December 6, 2022

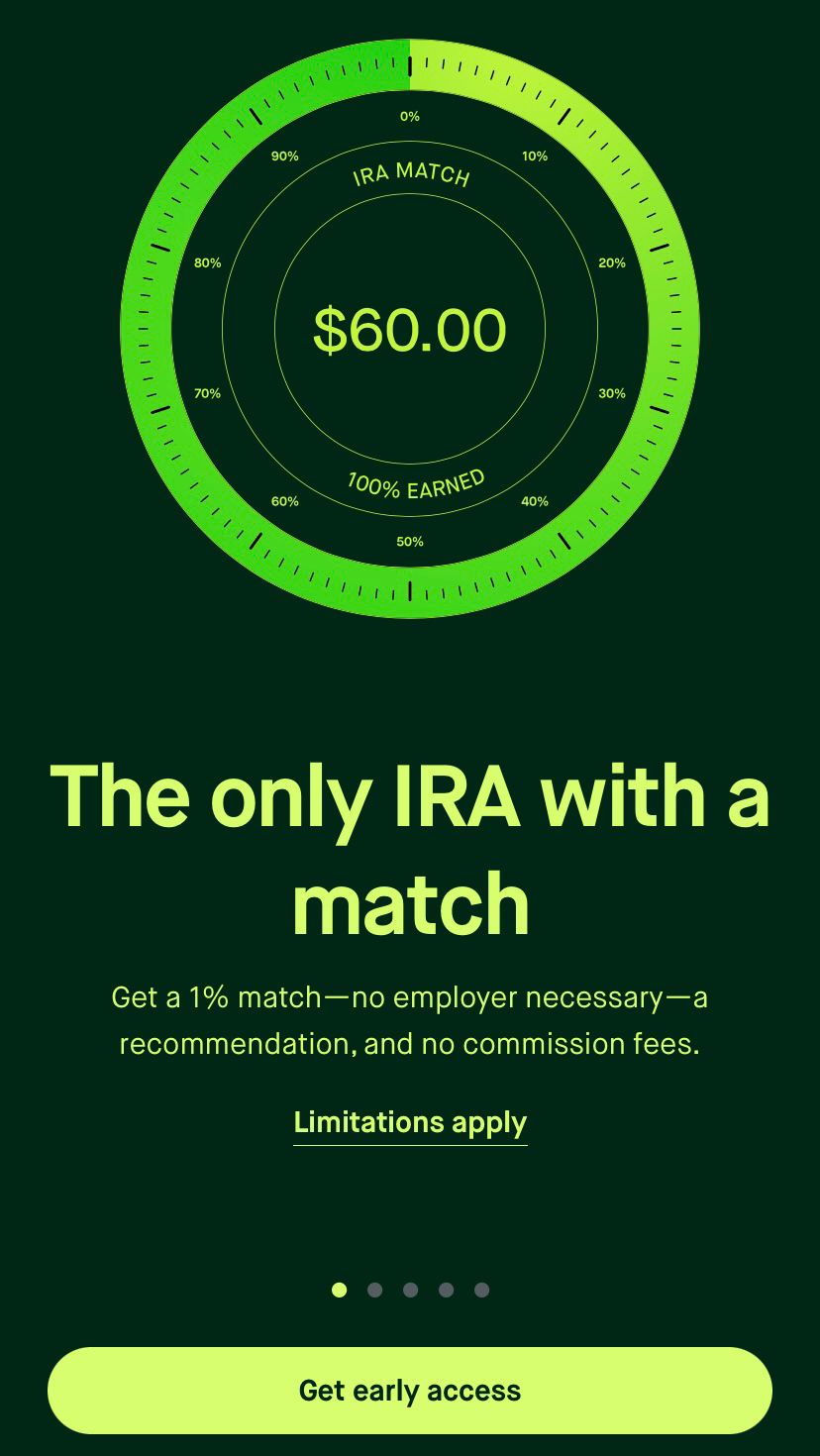

Unlike other IRA products on the market, Robinhood is offering a feature called IRA Match, which adds an extra 1% to your IRA for making eligible contributions. While the IRA Match is an unprecedented offering for IRAs, it still only amounts to $60 if you max out your 2022 contributions ($70 if you are 50 or older) and $65 if you max out your 2023 contributions ($75 if you are 50 or older). But hey, it's free money.

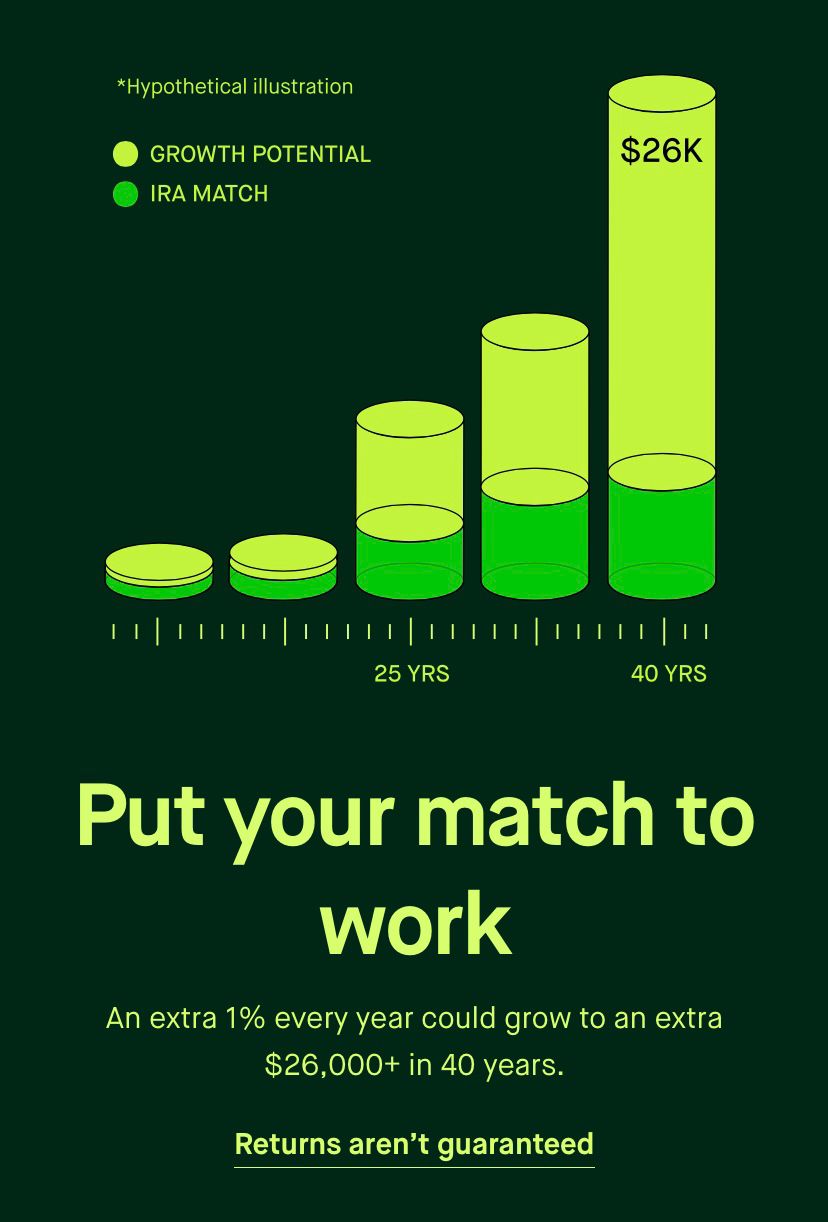

I admit, looking at only one year's worth of impact is not fair for IRAs. So let us take a look at the hypothetical growth potential over several years.

Robinhood "claims" that an extra 1% every year could grow to an extra $26,000+ in 40 years but also puts a disclaimer saying "Returns aren't guaranteed". So which is it? Well, if you navigate to the disclaimer link, you will find this note:

Annualized return rate of 10% is on par with what the S&P 500 has returned on average in the past 40 years, but we have also been in one of the biggest bull markets of all time. Still, it is free money. You will get a guaranteed $2400+ to reinvest over 40 years and have potential upside of $26,000+ if market continues to maintain it's current average return rate. Just make sure you stick with S&P 500 unless you know what you are doing!

Is Robinhood Retirement Worth It?

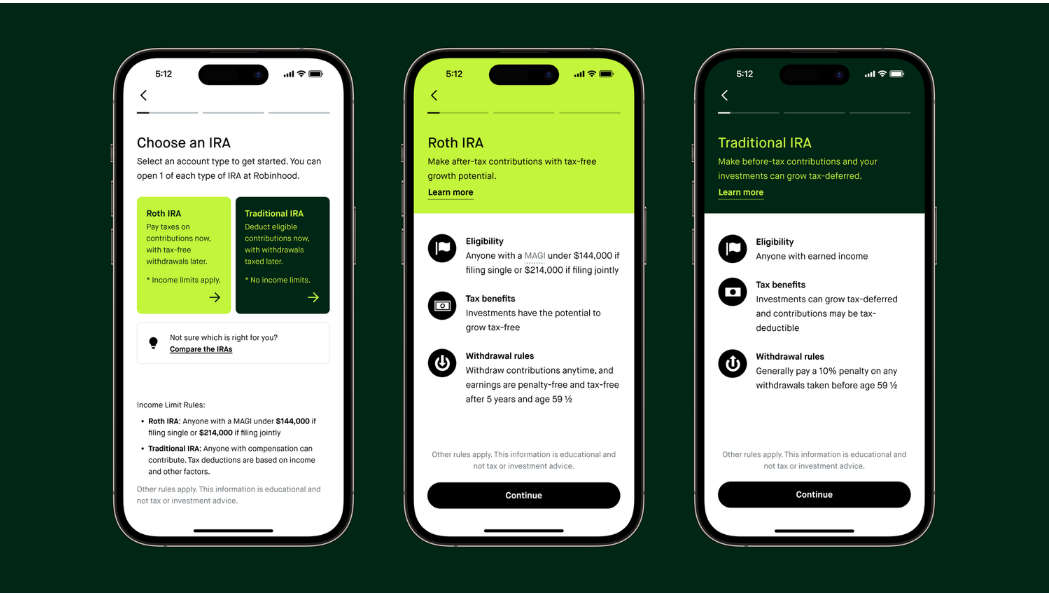

It depends. When it comes to Robinhood Retirement, the differentiating factor is the IRA Match. The IRA Match is good for those who like optimizing their finances and want to earn tax advantaged cash in their IRA. You may also want to use Robinhood Retirement if:

- You are already a Robinhood super user and have a cash account and brokerage account with them. You can additionally consolidate your retirement accounts into Robinhood for convenient access to all your financial accounts. Keep in mind IRA rollovers, transfers or conversions are NOT considered contributions (by IRS) and thus will not be eligible for IRA Match.

- You do not have an IRA account and want to start one with an app that has been regarded one of the simplest and best user experiences on the market.

You may not want to use Robinhood Retirement if:

- You already have an IRA account elsewhere and find it difficult to keep the contributions in your IRA for at least 5 years from the date you contribute.

For most financial institutions, a 5-year hold on an IRA account might not be that bad. However, Robinhood's performance has been underwhelming this year, with a year-to-date return of roughly -49%. So it is understandable to approach Robinhood Retirement with caution. The good news is that IRAs are protected by Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) which provides protection for up to $1 million in assets held in a traditional IRA or Roth IRA. So if your assets are less than that, you do have that peace of mind.

If you are interested in learning more about Robinhood Retirement, I recommend starting here at Robinhood's IRA Match FAQ.

If you're considering trying Robinhood Retirement or want to start investing with the company that revolutionized the industry with their exceptional user experience, you can use the referral link here to get started. Both the referrer and referee can get $5-$200 worth of fractional shares.

I hope enjoyed reading this post! Please subscribe to Pocket Finance Club to stay updated on the latest financial news and tools to improve your pocket.