Cracking the Code: How to Get the Best Public Credit Card Offers Every Time

Credit cards have become indispensable tools for managing finances, offering convenience, security, and the allure of rewards. However, with the multitude of credit cards available, each boasting enticing perks and benefits, the question arises: How can you consistently secure the best public credit card offers every time you apply?

Public Offers vs Targeted Offers

First off, it is good to understand the difference between a public offer and a targeted offer. A public offer is an offer that you can get by using a code or a link that is available to anyone publicly. A targeted offer is an offer you can only get from the company specifically reaching out to you and the code is specific for you (meaning you can only use once and for yourself).

The best of the best offers are usually targeted. However, it can be quite difficult to set yourself up for a targeted offer (there are ways to increase your chances but we won't go over it in this article). Targeted offers will typically be sent to you directly over email or mail.

Public offers are still very competitive but you have to put some effort into finding the best ones.

Public Offer Variance

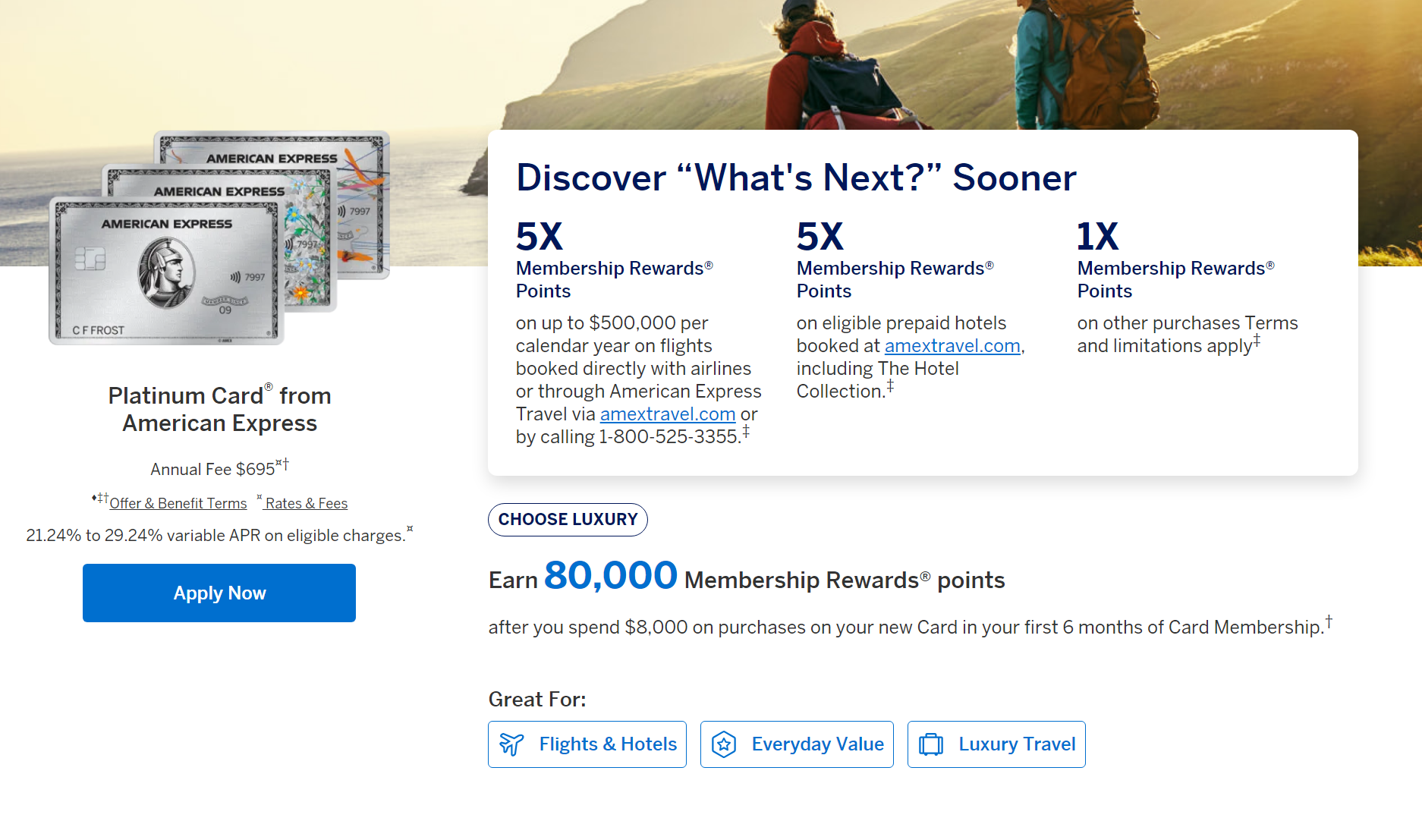

What you will notice with public offers is that they are not always the same depending on where you go. For example, going to the American Express website right now for the Amex Platinum card, I get the following offer:

On the other hand, I received a physical mail for 120,000 Membership Rewards points for a similar spend.

Both 80,000 and 120,000 Membership Rewards points is low compared to what you can normally get from Amex Platinum. If you are familiar with the card, the best public offer is usually around 150,000 Membership Rewards points which is almost 25-100% more than what's being offered! Knowing this, you would likely not go with this offer and wait. However, just because this offer shows up for you on the main website, doesn't mean that's the only offer you can get--so you might not need to wait.

Finding The Best Public Offer

Always getting the best public offer is pretty simple. You simply need to find an well known website that is an affiliate partner with a credit card network or company who provides offers. Visit their website as a "new user" (this can be done using Incognito mode on your browser). By doing this, the website will typically treat you better as a new user and will try to entice you with the best offer available (which is typically the best current public offer).

Which Affiliate Website to Use?

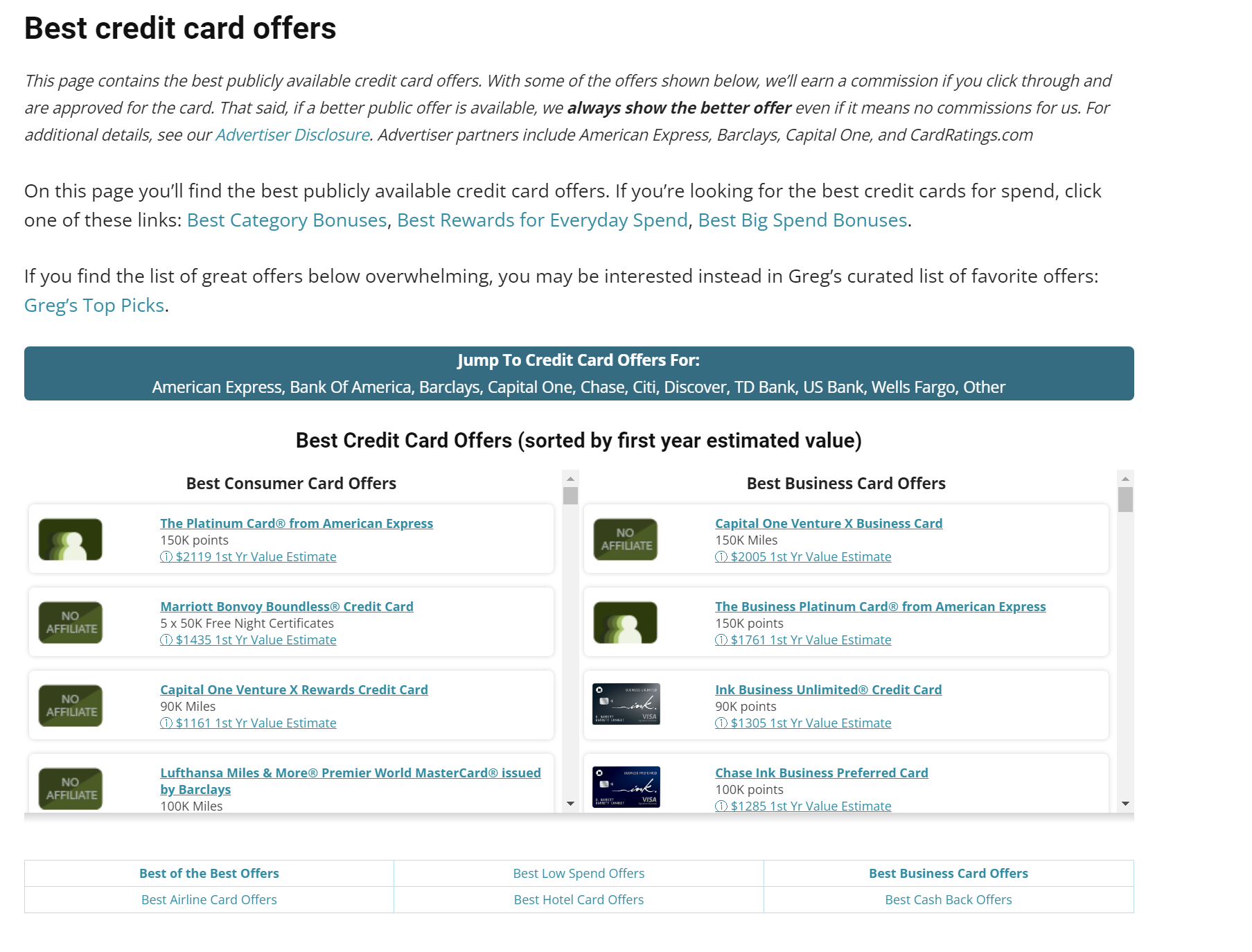

One popular affiliate website that can be used for finding public offers is Frequent Miler. They have a nice page where you can scroll through the best consumer credit card offers and best business credit offers. By visiting their offers page in Incognito mode, you will get the following:

If you notice in the image above, you will see that the Amex Platinum Card offer has a 150,000 Membership Rewards points bonus. Both screenshots were taken the same day so this means that Frequent Miler is able to provide a better offer than the main American Express Website! It's a very strange phenomenon to say the least, but it appears that convenience plays a big factor into this (the more convenient something is, the less incentive to give a better deal).

Final Thoughts

Well the secret is out! You now can get a bigger bang for your buck when you apply for your next credit card. It's been extremely helpful for me when I was adding more cards to my pocket (especially when it came to American Express and Chase cards). If you are in the market for a new card, I recommend doing some research on the historical public offers to get a baseline on what's a good offer for the card and then using the above technique to take a quick peek to see if it's currently available.

If you found this article helpful and informative, please consider subscribing to our newsletter! Receive regular updates on financial tips, strategies, and insights straight to your inbox.