Maximize Your Citi Card Benefits: Discovering Your Citi Flex Loan Offer

If you are in the market for flex loans, Citibank is another participant in this financial product space. Similar to other flex loans, this is a targeted offer for credit card holders and may or may not be limited to select credit cards backed by Citibank. Flex loans in general are notoriously opaque and there is usually little information on what credit cards are eligible for the offer and what underlying pre-requisites are needed to get this offer to show up. This applies to Citi Flex Loans as well. As you can see from Citibank's website, it does not go into much details about the Citi Flex Loan (the link just leads to the sign-in page or your account page if you are signed in already).

Since information on Citi Flex Loans is not easily accessible, I wanted go into some of the details of how Citi Flex Loans work and how you can get access to it.

Eligible Credit Cards

First off, let's talk about flex loan eligibility. Flex loans utilize the available credit limit of a credit card in order to finance the loan. The theory is that you are already permitted to access this revolving credit line so to speak, so it's a way to structure it with lower APR (thus why it's an offer). So when it comes to flex loans, the first thing you want to find out is which cards get these offers.

Unfortunately, Citibank does not provide a list of credit cards eligible for flex loans so you will have to rely on community reporting for the most part or try it yourself. I can confirm however that the Citi Custom Cash Card does get the Citi Flex Loan offer as I have received at least 3+ offers over the two years I have had the card. I suspect most consumer credit cards offered by Citibank might be eligible for Citi Flex Loan, excluding some card types like corporate cards, some co-branded cards, or cards that do not have a revolving credit line.

Flex Loan Offer

So what does it look like when you get an offer? Well, if you do get a Citi Flex Loan offer, Citibank does you a favor and will surface it as the first thing you see after logging into your Citibank credit card account. When the pop-up shows up, you can either check out the offer, ask Citibank to remind you later, or decline (which you can then check it out still in the dedicated offers page).

Loan Structure

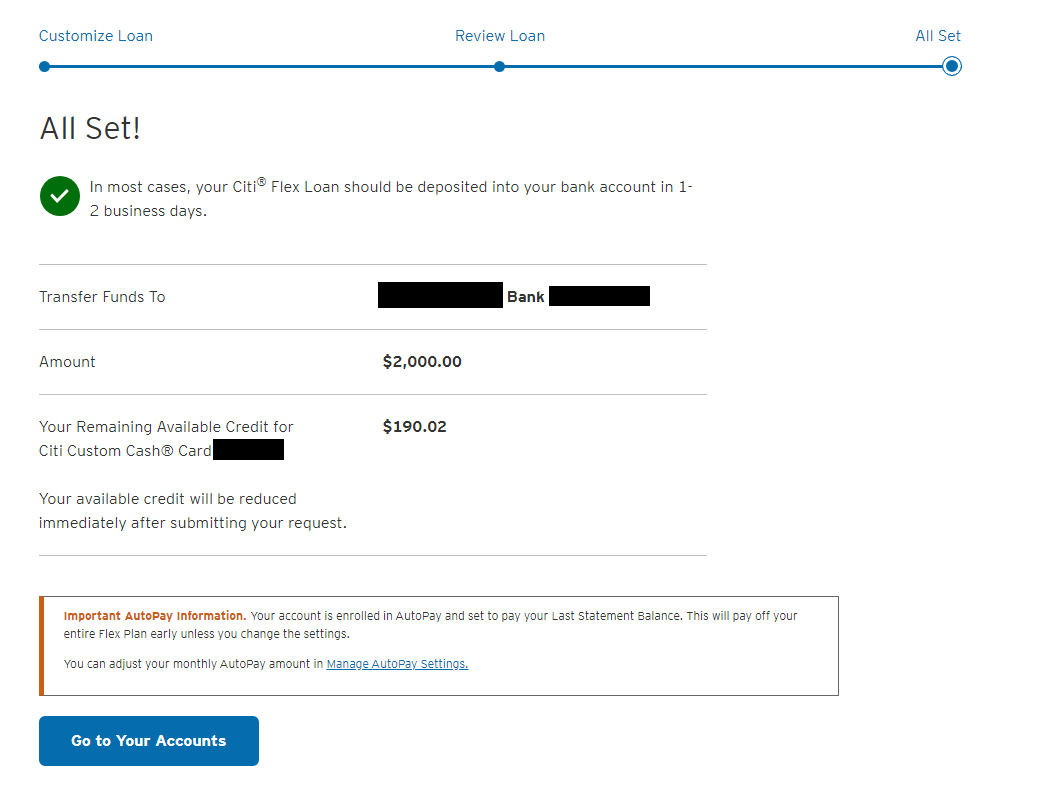

When you check out the offer on your Citibank online account, Citibank will first prompt you for your desired loan amount. Citibank will allow you to take up to your available credit line. For example, if you have a $3,000 credit line and your current balance is $800, then you would be able to take out $2,200.

After you select your desired amount, you will then need to select the duration of time over which a loan is scheduled to be repaid (aka loan term). The shortest loan term is 12 months and the highest is 60 months. As with most loans, the APR is higher for longer loan terms. In my most recent experience, the difference between the 12 month loan term and the 60 month loan terms is 2% (specifically it was 13.99% for 12 month loan term and 15.99% for the 60 month loan term, on 2/6/24).

Once you have landed on both the desired amount and the loan term, you can continue to fill out which bank you want the loan to be routed to and complete your loan acceptance. The final page will look like the below:

Final Thoughts

Flexible loans are a great utility for cash advances and their rates are sometimes slightly more favorable than personal loans. It is still important however to be cautious about overextending yourself with too many loans though because flex loans still have a relatively high rate. I think a healthy way to think of this is an emergency credit line where you won't be burdened with credit checks or other risks in getting a loan when you actually need it. Having a credit card on hand that gives you this potential/option can be helpful.

For myself, I use flex loans as cash advances to pay for expenses that require hard cash. I typically pay off the loan in the next few paychecks (and fortunately no pre-payment penalty if you pay off your entire flex loan) and don't hold it for the entire loan term. Since flex loans are more or less random, I don't really factor it into my finances proactively, but I'll strategize with it once that offer shows up.

If you are looking to add more flex loan products into your pocket, you can also check out My Chase Loan which is another flex loan product.