Net Worth Investing: Facing the "Should I Sell?" Dilemma

Whether you're a novice investor or have years of experience, you will inevitably face the challenging question, "Should I sell?" This is often the most stressful aspect of investing, as it rarely feels like you sold at the perfect time. The frustration intensifies if you realize that holding on for just a day or a week longer could have resulted in even greater gains.

Many strategies for selling are available online or through social media, but they often become ineffective in the long term unless you are nearly a full-time investor, able to consistently apply these strategies, which require deep analysis of live markets. So, what can you do to manage your investments more effectively without dedicating an abundant amount of time to staying on top of the markets? You might consider net worth investing.

What is Net Worth Investing?

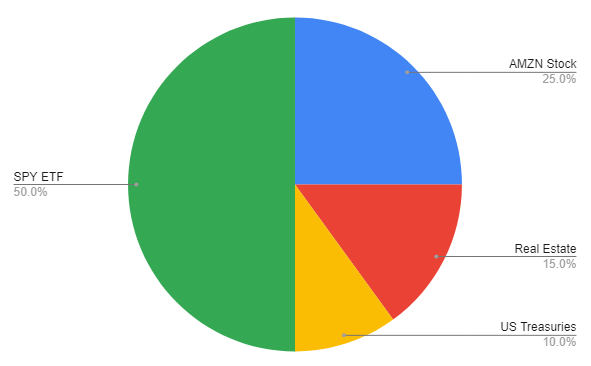

Net worth investing is a strategy where you allocate percentages of your net worth to different investments based on your financial objectives. With net worth investing, every investment or asset class you invest in becomes a percentage that you adjust to meet your financial goals. Here is an example of net worth investing:

In the pie chart above, all the investments are itemized and given a percentage with respect to their contribution to net worth. This is a very important view to track and see how each investment is weighted for your net worth. However, this is just the first step to the process of net worth investing. The next step is to establish target percentages that align with your financial objective(s).

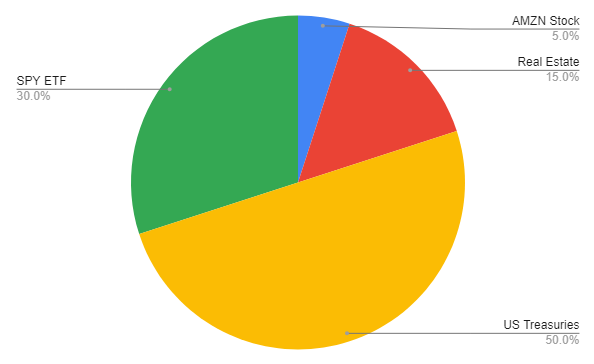

For example, let's say your near-term financial objective is to save for a new home purchase in the next year or so. In the current example, we can see that about 75% of your net worth is invested in stocks and ETFs, which is quite aggressive and a bit more volatile. Given this, you might want to move towards more stable investments, such as US treasuries or cash in high-yield savings accounts. To accomplish this, you could adjust your target percentage to allocate 50% to US treasuries instead of 10% and reduce your exposure to stocks and ETFs. By decreasing your exposure to AMZN stock and the SPY ETF, you could make more room for US treasuries, resulting in a revised allocation. It would look like the following:

As you can see, it's as simple as just shifting the percentages, but the more intricate part is how you get from point A (your current allocations) to point B (your desired allocations). You typically can do two things:

- Rebalance - You sell your overweight allocations and buy your underweight allocations with the sale which brings everything to the right target percentages. In the example above, you would sell SPY ETF and AMZN stock and use those proceeds to buy US treasuries.

- Adjust Future Contributions - You put your future paychecks into your underweight allocations until it gets to the target percentage.

Implementing a Net Worth Investment Strategy

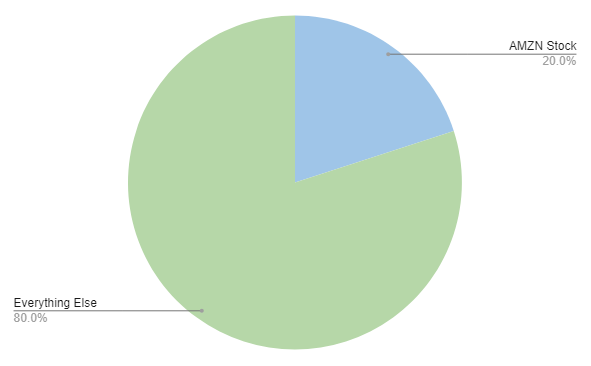

The beauty of net worth investing is that it can be applied at any scale and doesn't have to encompass everything. While mapping out the weight of every investment can be helpful, it might be overly taxing to maintain. You can keep it simple and focus on the investments you want to adjust occasionally to ensure healthy exposure. For instance, if you work for Amazon or another publicly traded company where a large portion of your compensation is the company's stock, you may want to apply net worth investing only to that allocation and leave the rest of your investments as a blanket "Everything Else" category. Let's say you are comfortable maintaining 20% of your net worth in AMZN stock; it would look like the following:

Every time your AMZN stock's value exceeds 20% of your net worth, you sell! This approach makes it easy to decide when to sell (and also when to buy). You can apply the same strategy to any other investment you want to manage more closely.

Does This Actually Work?

Ultimately, the effectiveness of this strategy depends on your personal experience, but it generally works well, in my non-financial advisory opinion! The main reason is that, time and time again, "time in the market" always beats "timing the market." Execution is less important than managing your exposure to investments and asset classes to meet your financial objectives. By applying net worth investing, you will gain better visibility and control over how certain investments impact your net worth. Risk management is the most crucial part of investing!