Tracking Your Fidelity 401(k) Contributions: A Quick Guide

Fidelity stands out as a widely preferred brokerage utilized by numerous companies for their 401(k) provisions. Occasionally, you might wonder, "Where can I access details regarding my contributed amount?" Locating this information might not be straightforward, so I put together a quick guide below. This guide outlines the steps necessary to navigate and view both your personal contributions and those made by your employer.

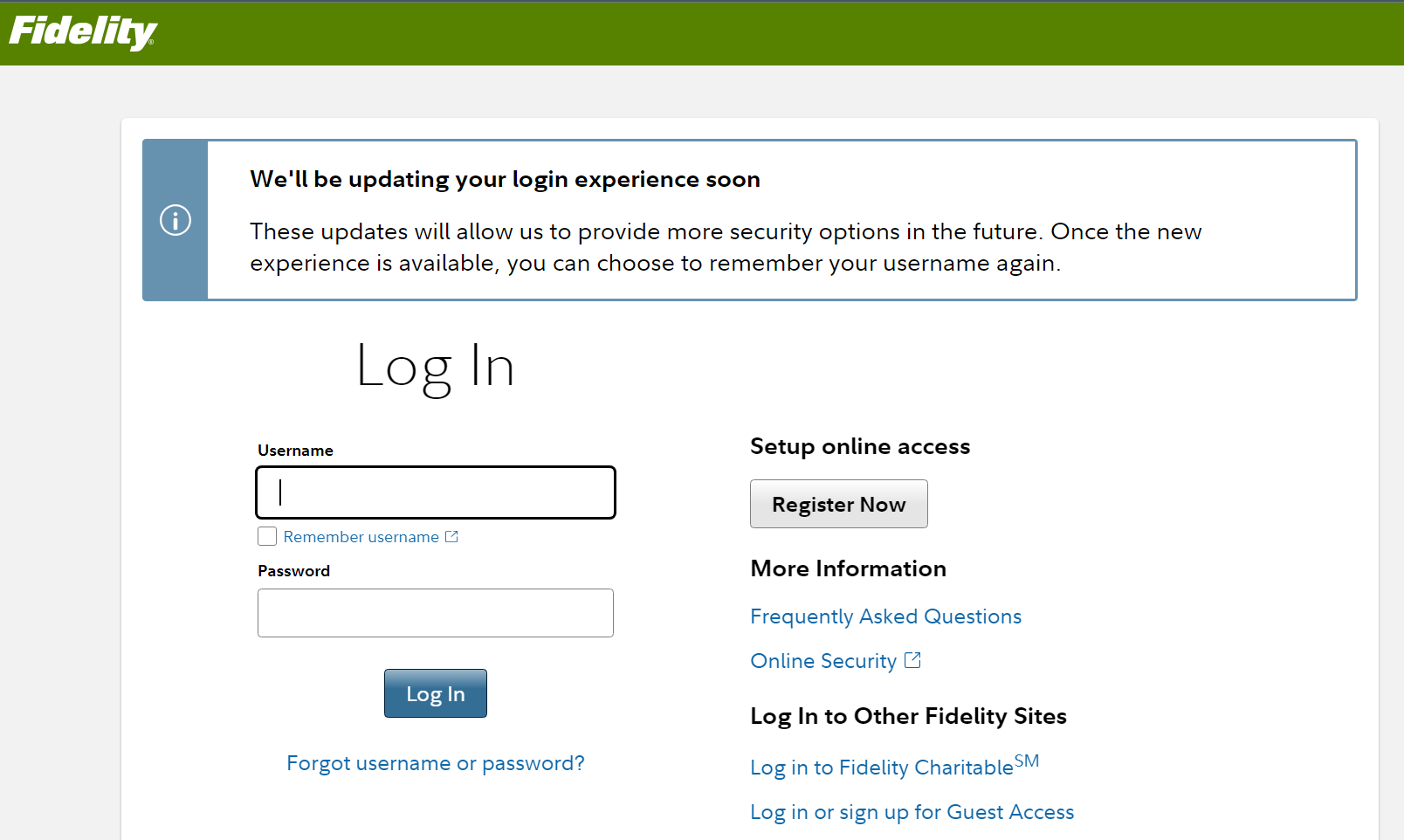

Step 1: Log in to your Fidelity Account

Visit Fidelity's official website and log in to your account using your username and password.

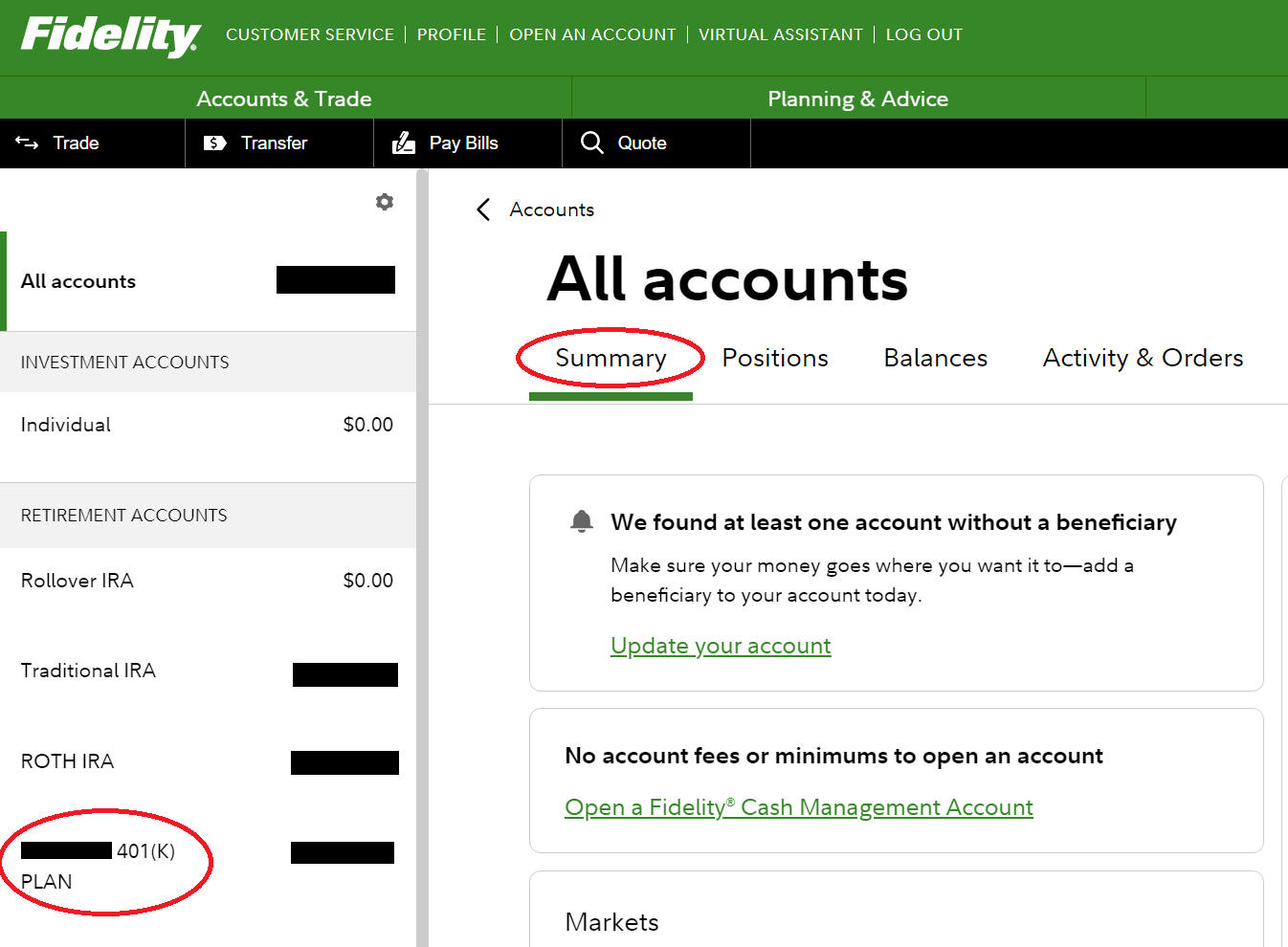

Step 2: Navigate to your 401(k) Summary Page

When you log in, you will be directed to your home page which shows all your Fidelity accounts. It should default to the Summary tab, but if not, please make sure the Summary tab is the active tab by selecting it.

Then click on your 401(k) account on the left (where all your Fidelity accounts are listed). It should take you to your 401(K) Plan account page.

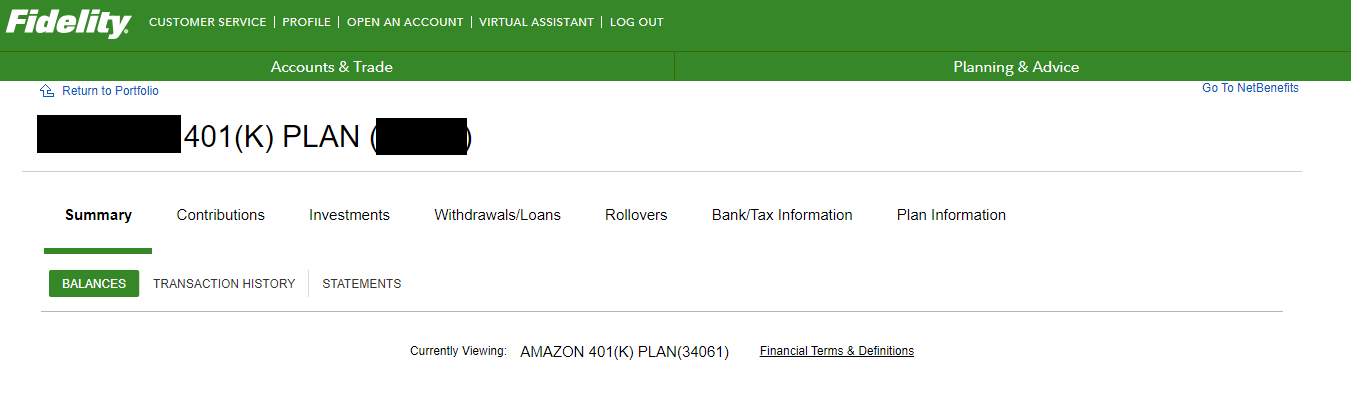

Step 3: Navigate to Transaction History

On the 401(K) Plan account page, under the Summary tab (too many summary tabs), click on Transaction History sub tab. This will bring up the Transaction History Overview and 3 options. Click on the Transaction History option (first option).

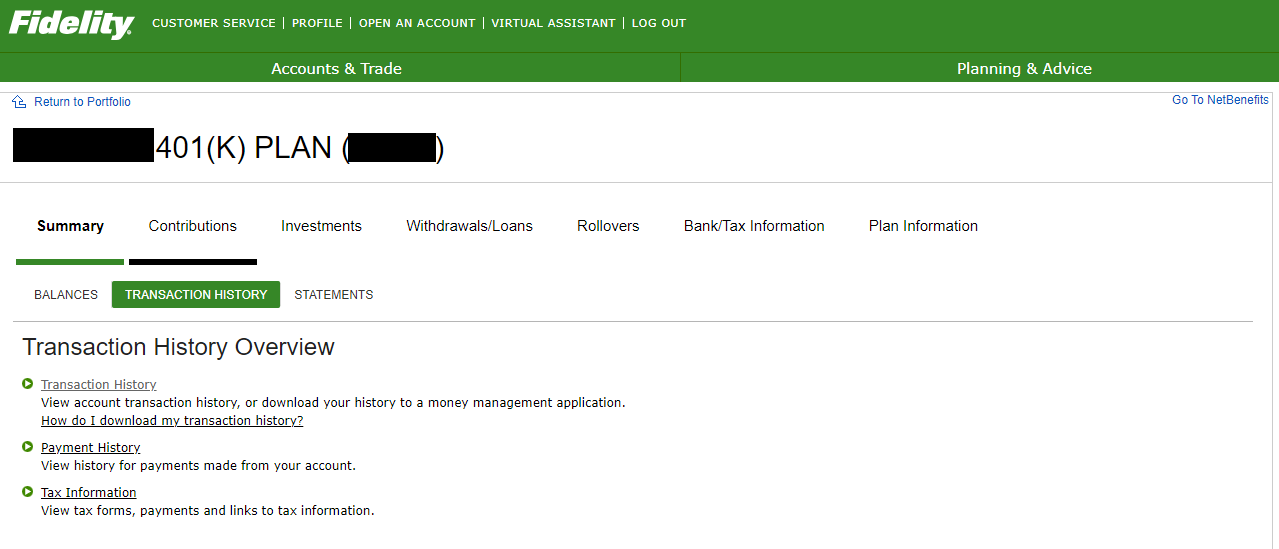

Step 4: Get YTD Contributions

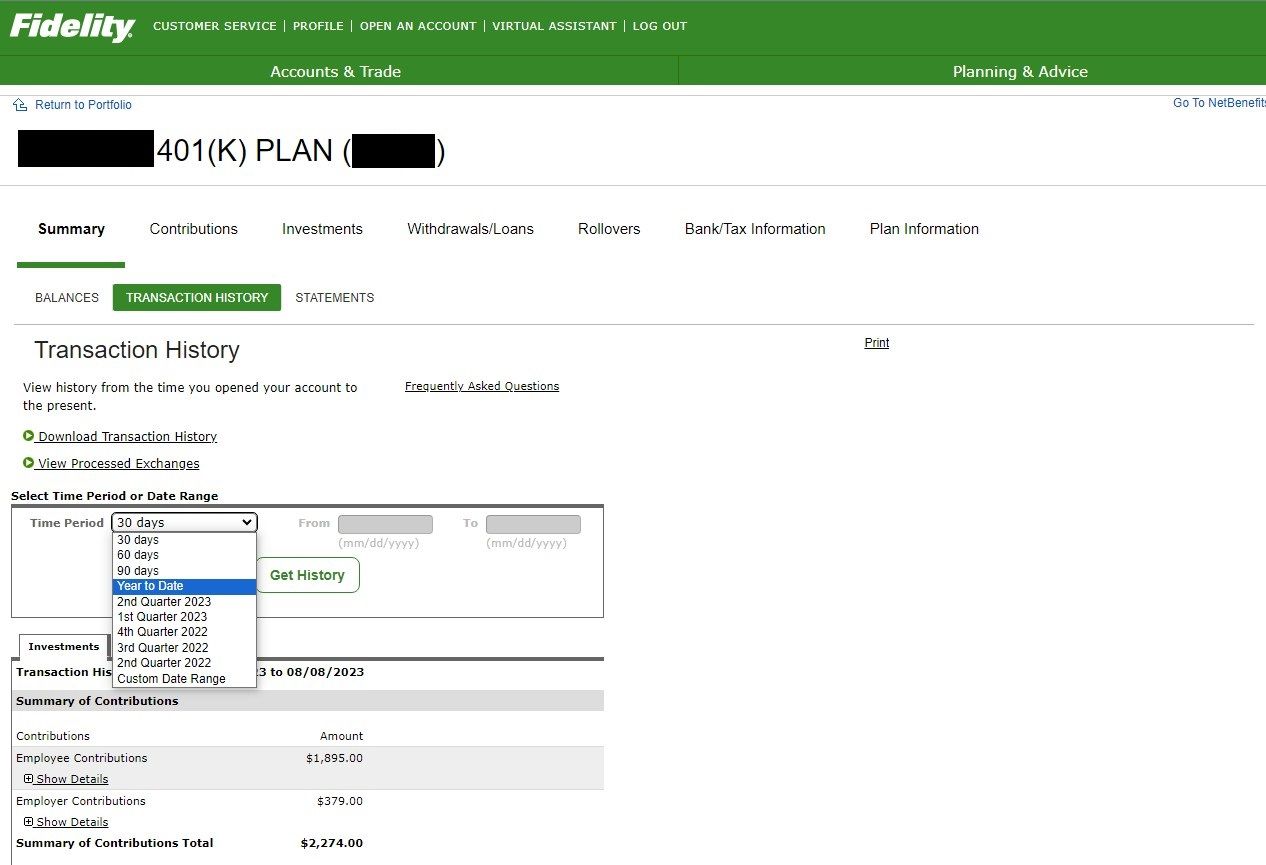

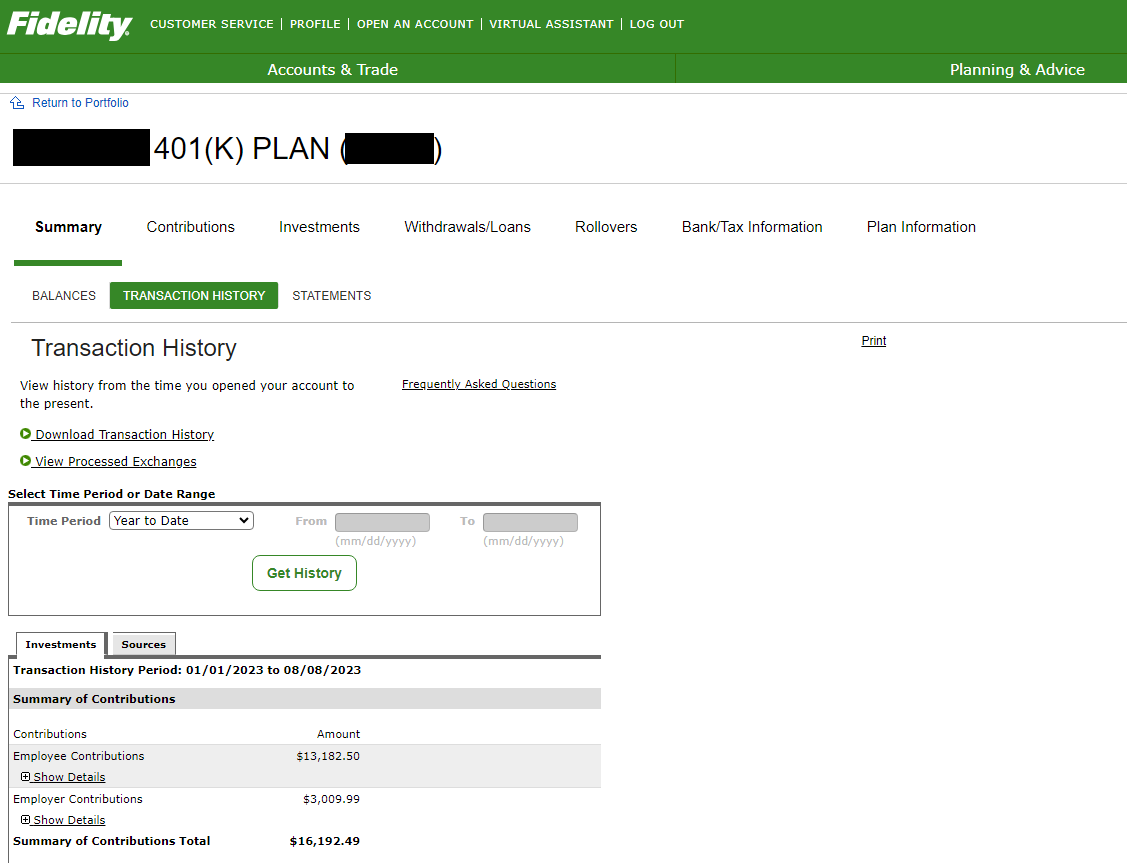

When you arrive at the Transaction History page, you will see that the time period is defaulted to 30 days. Use the dropdown and select Year To Date. This will make it show all contributions made by you and your employer for this calendar year (so far).

The 401(k) contribution limit for employees is $22,500, or $30,000 if you are age 50 or older for 2023. This amount is an increase from 2022, when the individual 401(k) contribution limit was $20,500, or $27,000 for employees who were 50 or older. Keep in mind, this contribution limit only applies to your contributions, not your employer's matching contributions!