How to Buy US Treasuries on Fidelity

If you are currently a Fidelity customer or planning to open a Fidelity brokerage account, you might be interested in investing in US Treasuries. Purchasing newly issued US Treasuries on Fidelity is a straightforward process:

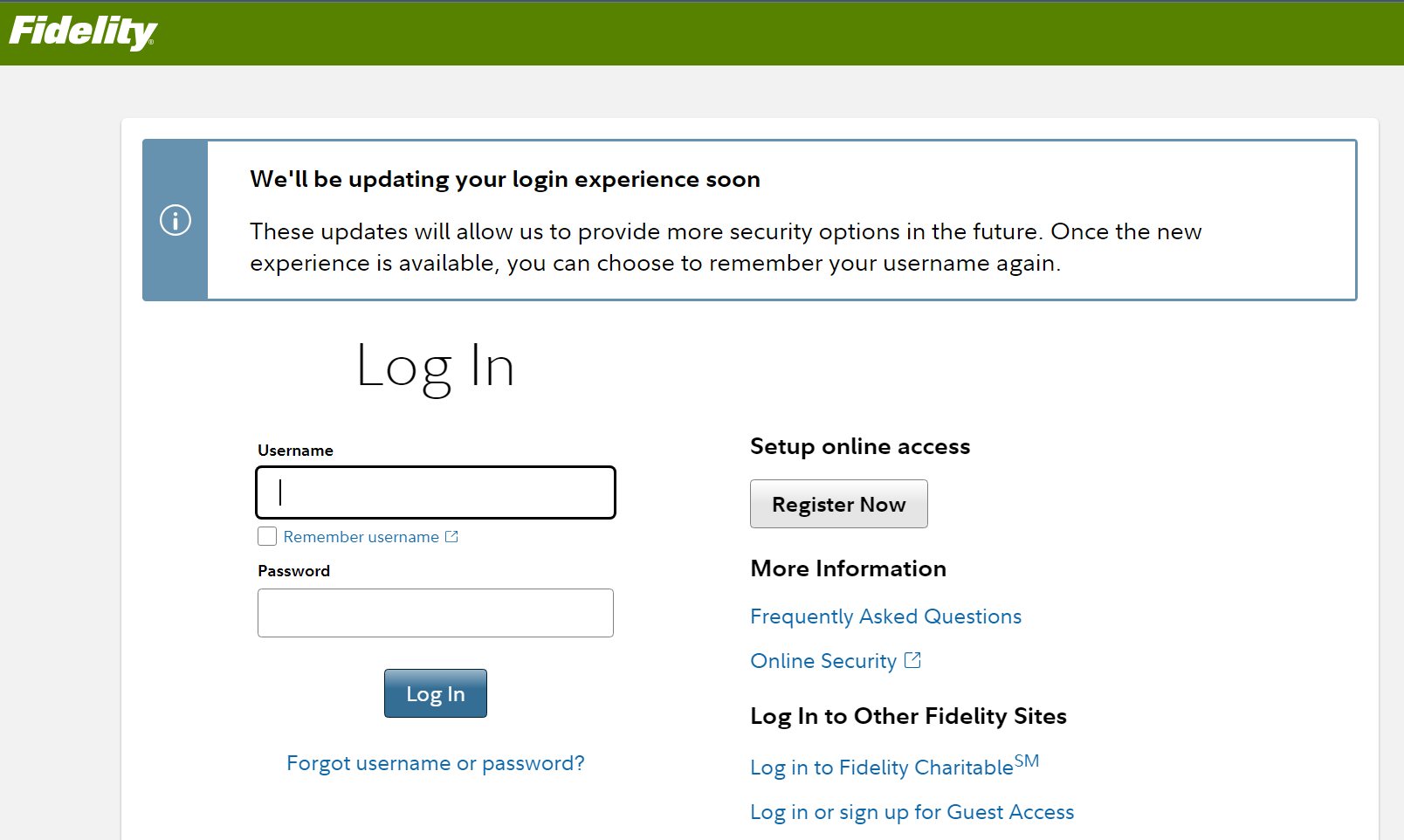

Step 1: Log in

Log in to your Fidelity Account Visit Fidelity's official website and log in to your account using your username and password. If you haven't created an account yet, you can easily sign up for one on the website.

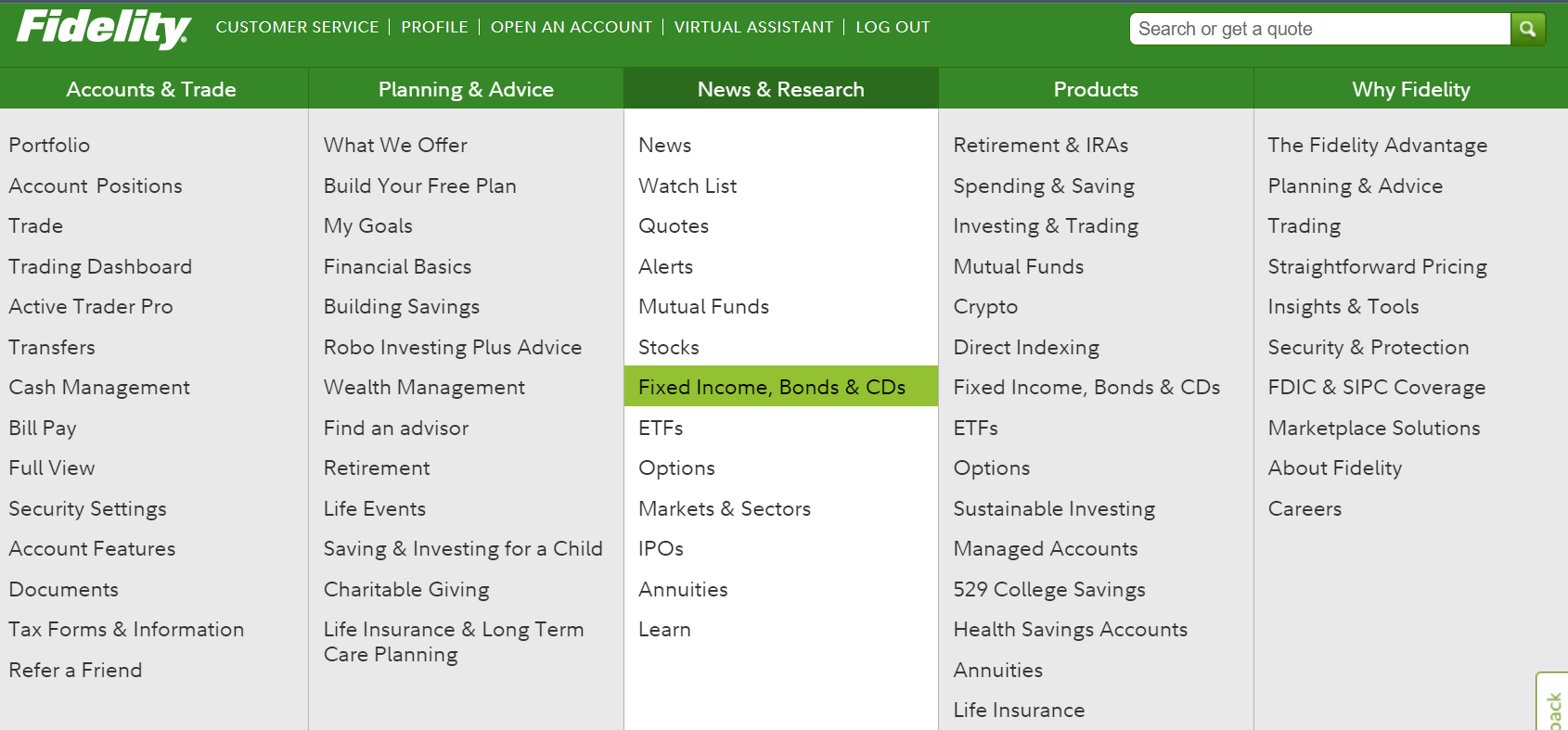

Step 2: Access the Bonds & CDs Section

Once you are logged in, navigate to the News & Research tab on the top menu bar. Under this tab, you should find a section called Fixed Income, Bonds & CDs. Click on it to access the bond trading platform.

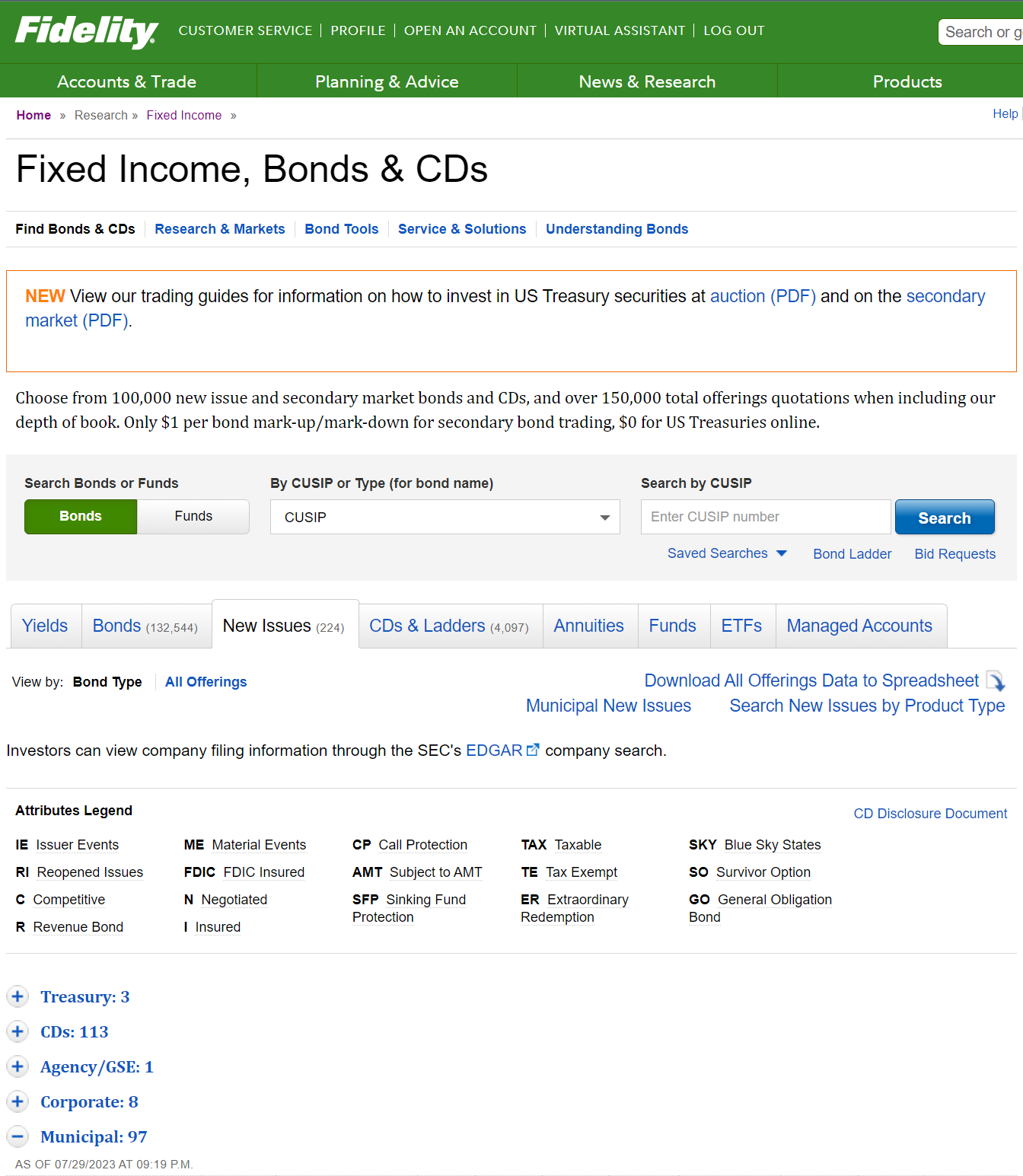

Step 3: Find New Issues

On the bond trading platform, you'll see a several tabs with different offerings. Look for the New Issues tab and click on it. This will make so that only the auctioned treasuries are listed (not secondary market ones).

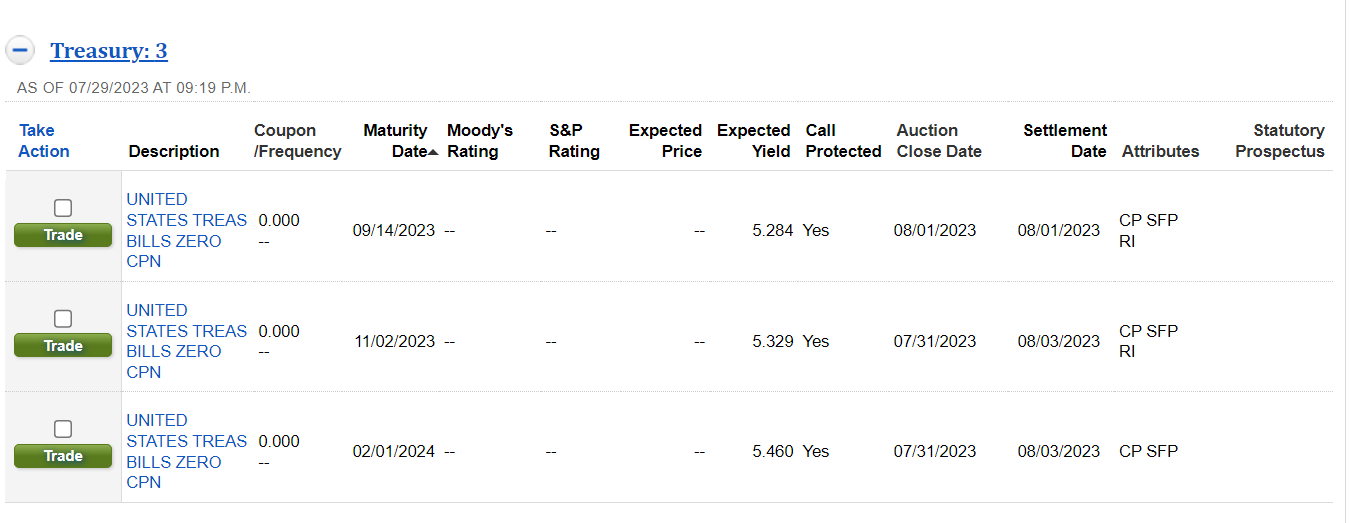

Step 4: Select an Offering

Expand the Treasury section. You will see a list of newly issued Treasury bonds with their respective maturities and interest rates. Review the available options and choose the bond that suits your investment goals and timeline.

Once you've selected the Treasury bond you wish to purchase, click on the Trade button next to the bond's information. This will initiate the buying process.

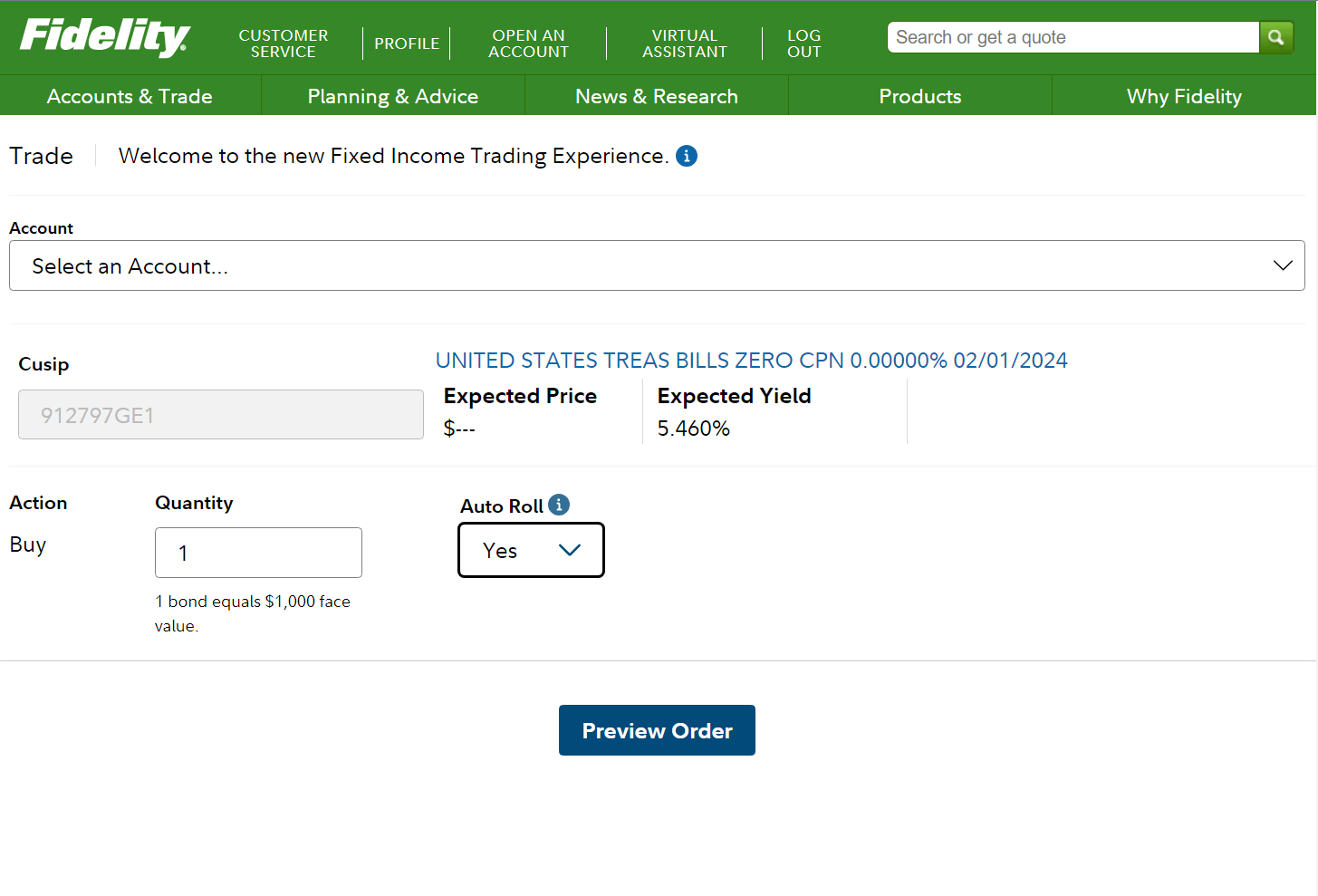

Step 5: Enter Purchase Details

You'll need to specify the quantity (face value) of the Treasury bond you want to buy and review the total cost, which will include any transaction fees.

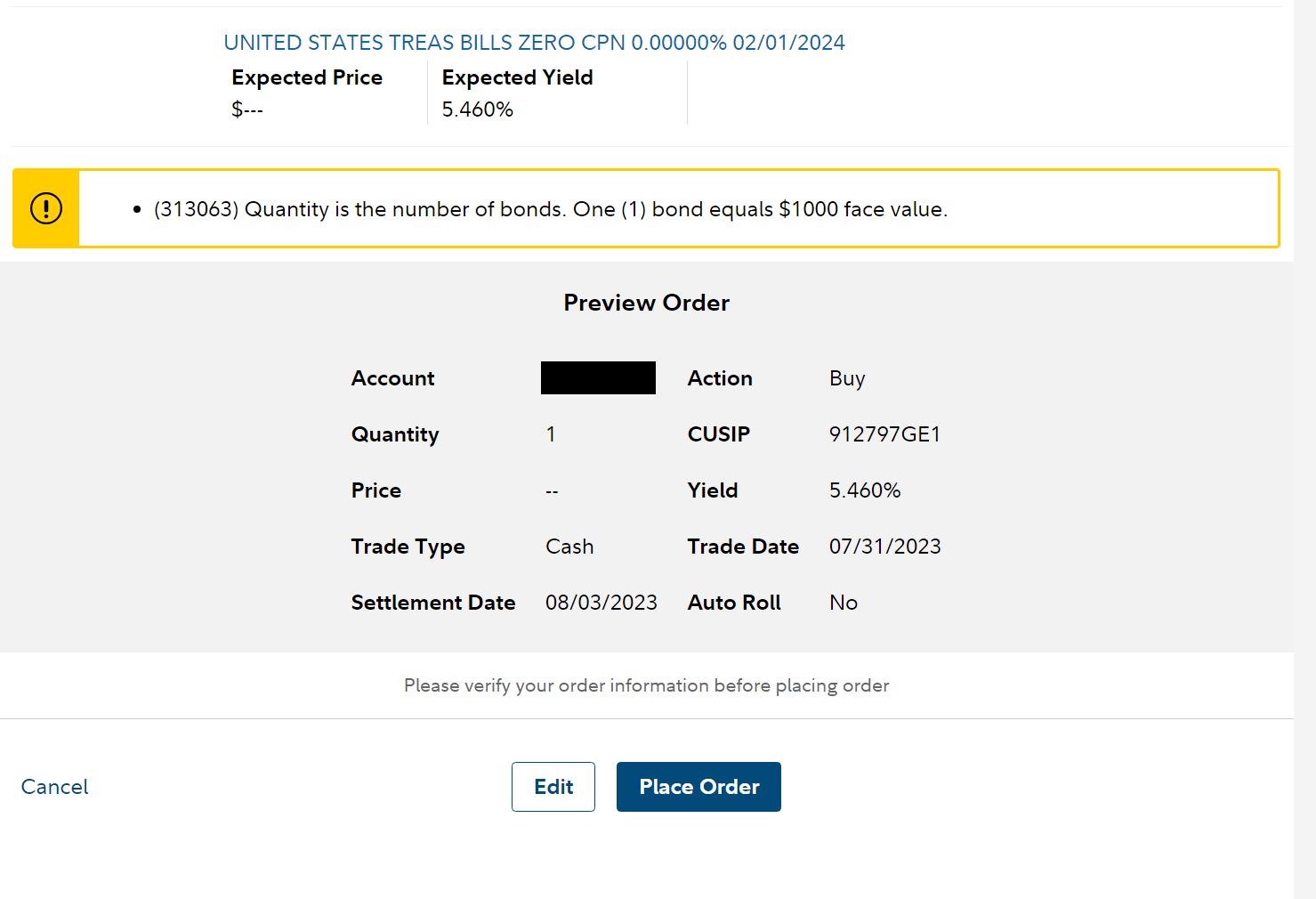

Step 6: Place Order

After reviewing your purchase details, confirm the transaction. You may be required to enter a verification code for added security. Once confirmed, your order will be placed, and you will receive a confirmation of the purchase.

Step 7: Settlement and Ownership

After the purchase is completed, the newly issued Treasury bond will be added to your Fidelity brokerage account. You will now be the owner of the Treasury bond, and its value will be reflected in your account holdings.

Final Notes

Remember that Treasury bonds have various maturities, ranging from short-term (e.g., Treasury bills) to long-term (e.g., Treasury bonds). Choose the one that aligns with your investment horizon and risk tolerance.

Please note that the above instructions are for purchasing newly issued US Treasuries on Fidelity. If you are interested in buying Treasury bonds from the secondary market, the process is slightly different, and the selection of available bonds may vary.

Before making any investment decisions, it's always a good idea to do thorough research and, if needed, consult with a financial advisor to ensure your investment aligns with your overall financial goals and risk tolerance.