Fidelity Rewards Visa Signature Credit Card - 2% Cash Back on Everything

The Fidelity Rewards Visa Signature Credit Card is a competitive 2% universal cash back card with no annual fee. This makes it great for a backup card in situations where you are not sure what the purchase category is or if you know the category won't maximize cash back on your other cards.

Fidelity Rewards Visa Signature Card

- Unlimited 2% cas back

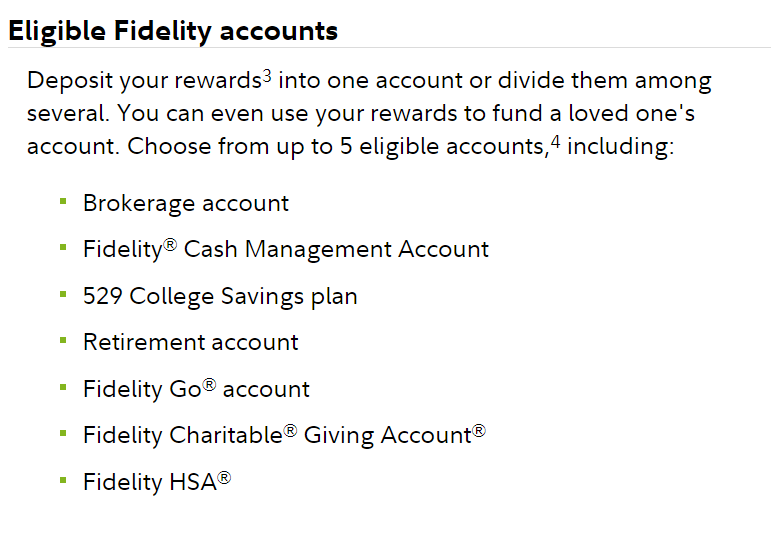

- Deposit your rewards into any eligible Fidelity account, such as a brokerage account, Cash Management Account, or a 529 college savings plan

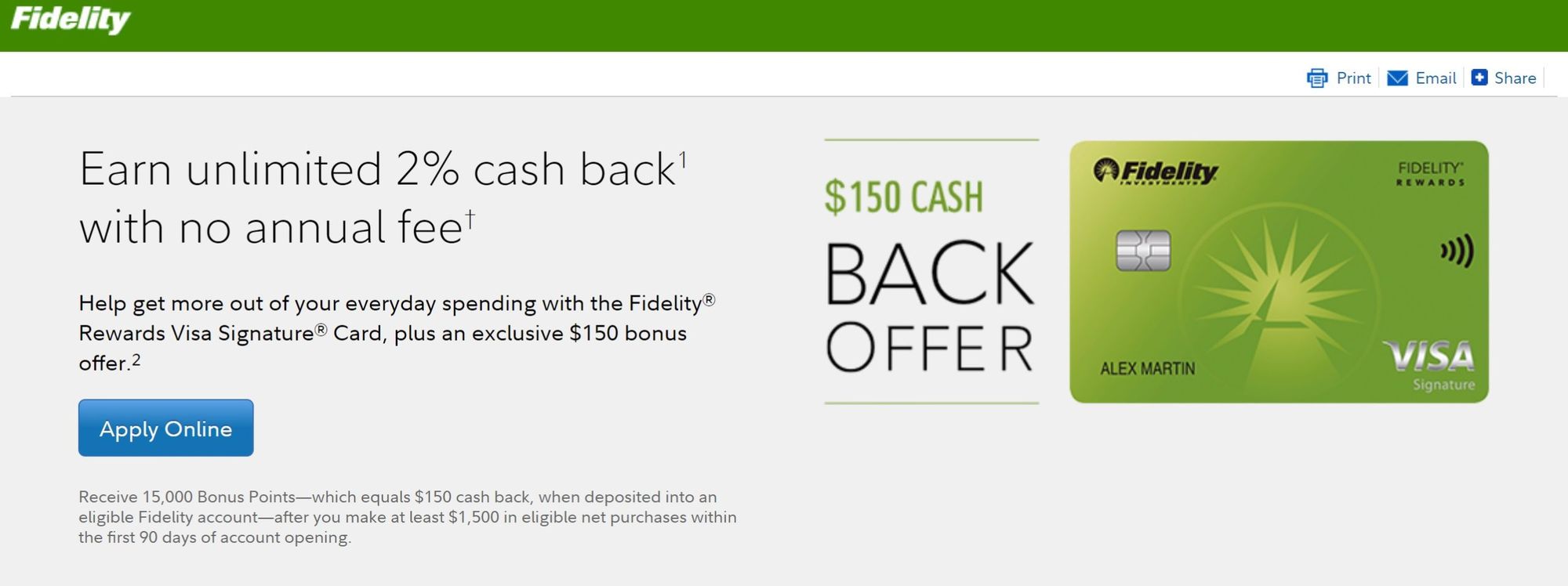

- Targeted welcome bonus ($100-$150)

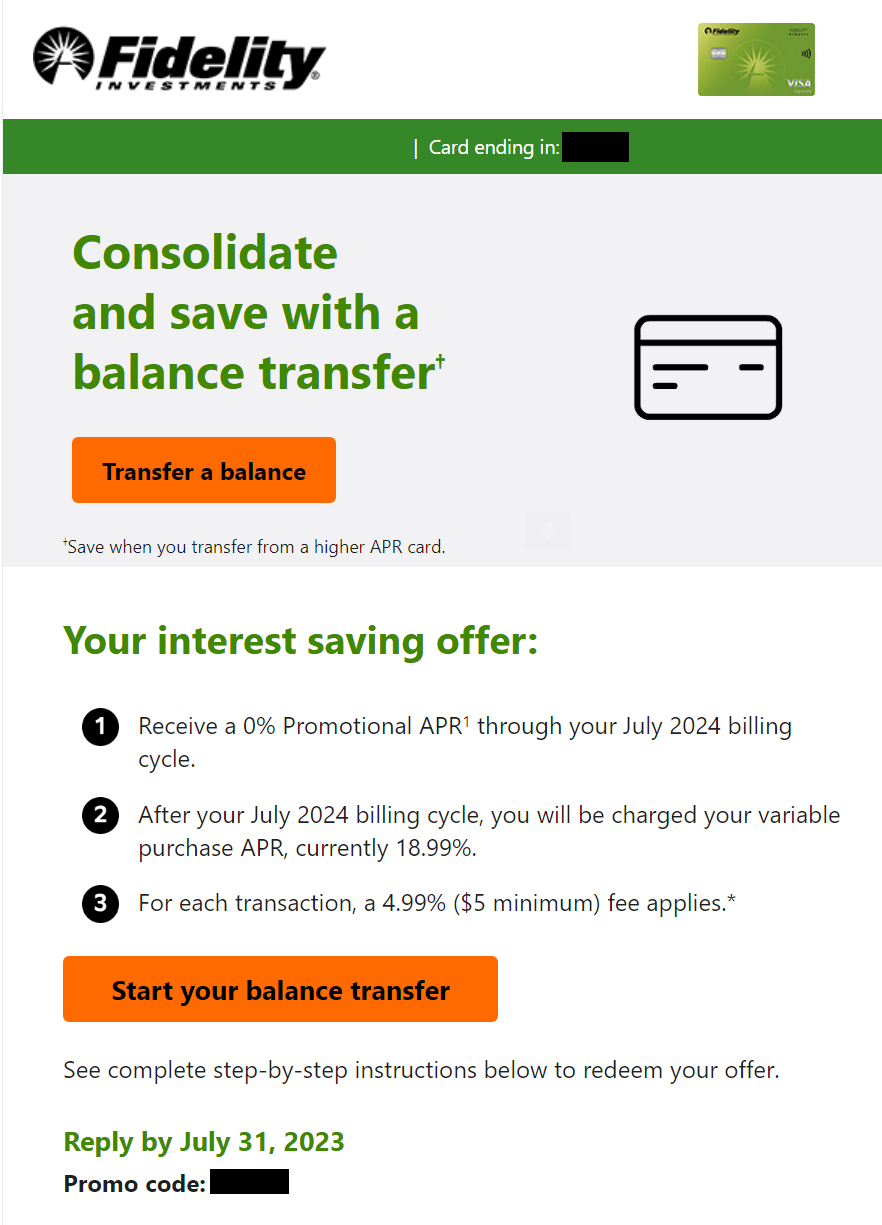

- Targeted offers for balance transfers

- Visa Signature perks

Like most 2% universal cash back cards, the Fidelity Rewards Visa Signature card offers some extra perks unique to this card which might make it more attractive than others.

Key Benefits

Direct Rewards Deposit

What makes Fidelity Rewards Visa Signature stand out amongst other 2% universal cash back cards is that it pairs really well with Fidelity accounts (brokerage account, 529 college savings plan, etc). The rewards from the card can be deposited directly to any eligible Fidelity account (see list below), making it an easy way to manage where you want your cash back to go and set it in auto-pilot mode.

Welcome Bonus

The Fidelity Rewards Visa Signature card offers a welcome bonus but it's targeted. In order to get the welcome bonus offer, you need to have an existing Fidelity account and just wait for them to send you the offer (usually via mail). The welcome bonus is either $100 or $150 and it requires spending around $1,500 in the first 90 days of account opening.

Balance Transfer Offers

Probably one of the most powerful features of the Fidelity Rewards Visa Signature card is the targeted balance transfer offers. The balance transfer offer comes in conjunction with a 0% APR period (usually 1 year), meaning you do not accrue interest by letting your statement balance float month over month. You just have to pay the minimum payment for the next year. Then at the end of the period, you will need to pay the full amount before the default APR kicks back in.

To get the targeted offer, you need to wait until Fidelity decides to send you one. I got mine in an email (see screenshot below).

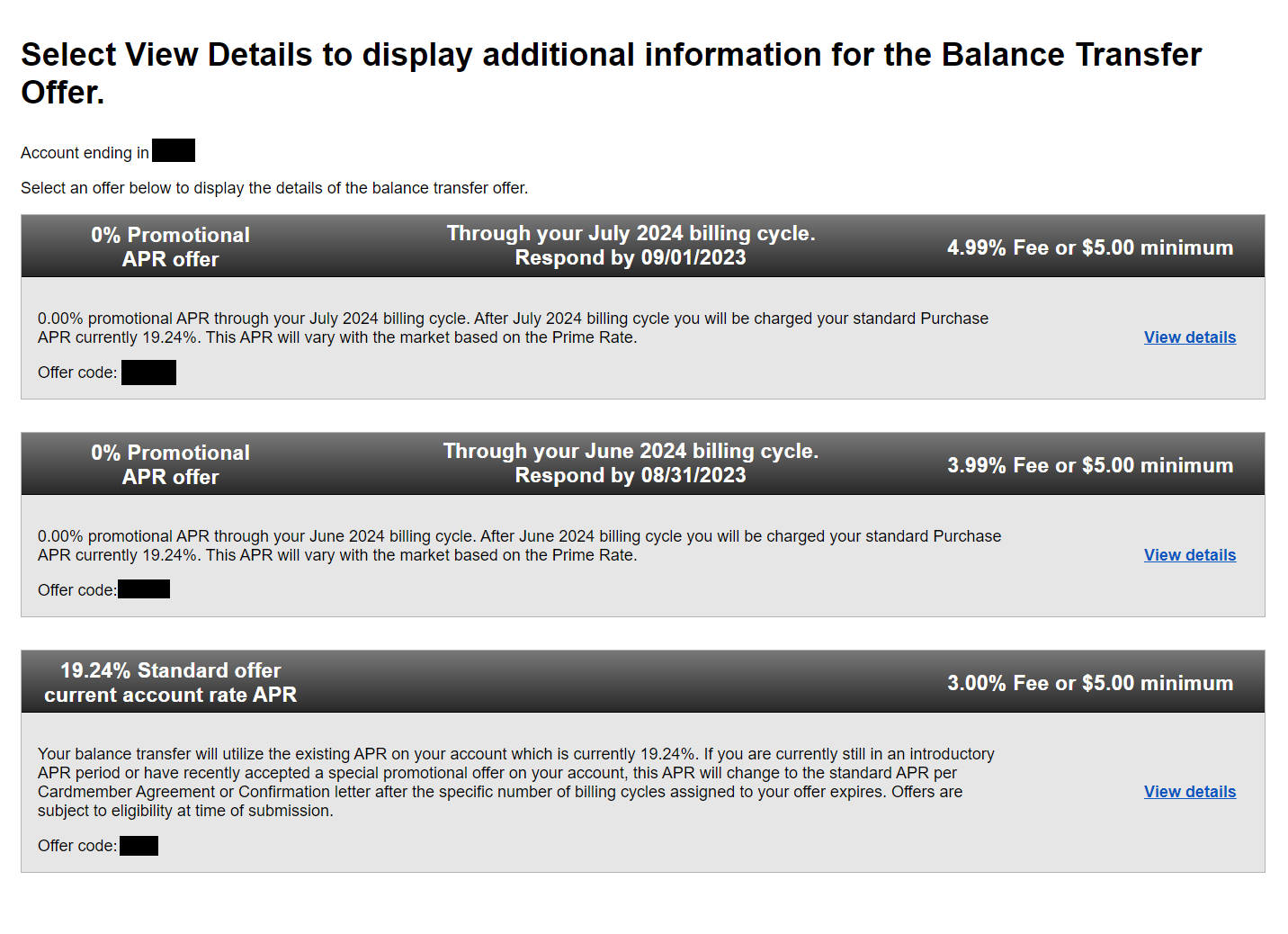

When you click on Transfer a balance or Star your balance transfer, you will be taken to the Fidelity website where it will prompt you to login. Then after logging in, you will be presented with all the active balance transfer offers you have received including the one from the email.

The balance transfer offer can be used indefinitely until it expires. The best way to take advantage of this offer is to have a large credit limit so you can roll as much as you need there (assuming you would be charged interest anyways and do not plan paying off the balances prior to interest accrual) so that's why I recommend you plan ahead and take steps to master your credit.

Final Thoughts

I personally have the Fidelity Rewards Visa Signature Credit Card in my pocket. I have several of my accounts with Fidelity so it felt natural to take advantage of the easy direct deposit of rewards into them (specifically a 529 plan). The balance transfer offers is something I overlooked initially but really began to appreciate more how powerful this is. Typically you would need to open a specific credit card to get this benefit but having the Fidelity Rewards Visa Signature card makes it a feature you can utilize without incurring a new card and hard inquiry. If you are new to Fidelity and are interested in this card, I recommend getting started with another promotion they are doing now to potentially get the welcome bonus offer.