M1 Review 2023

What is M1?

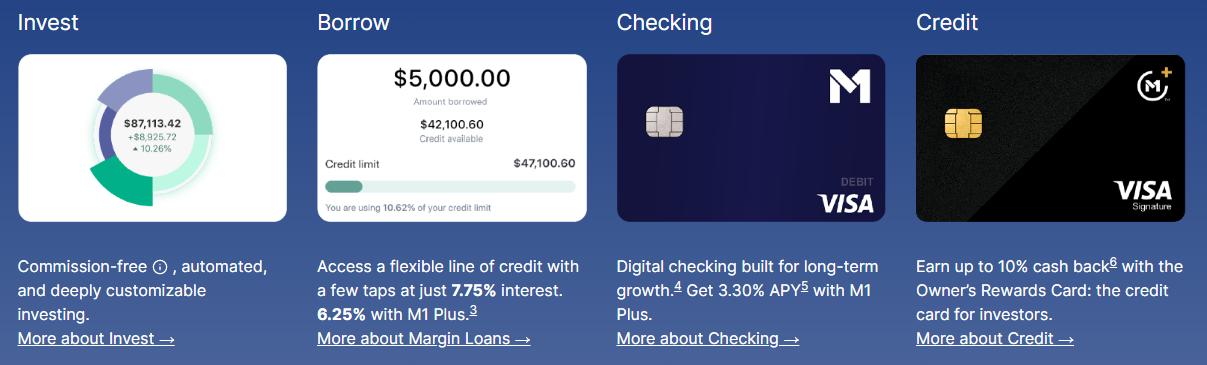

M1 (previously known as M1 Finance) is a financial platform that offers a range of financial products and services.

The Good

Portfolio Investing

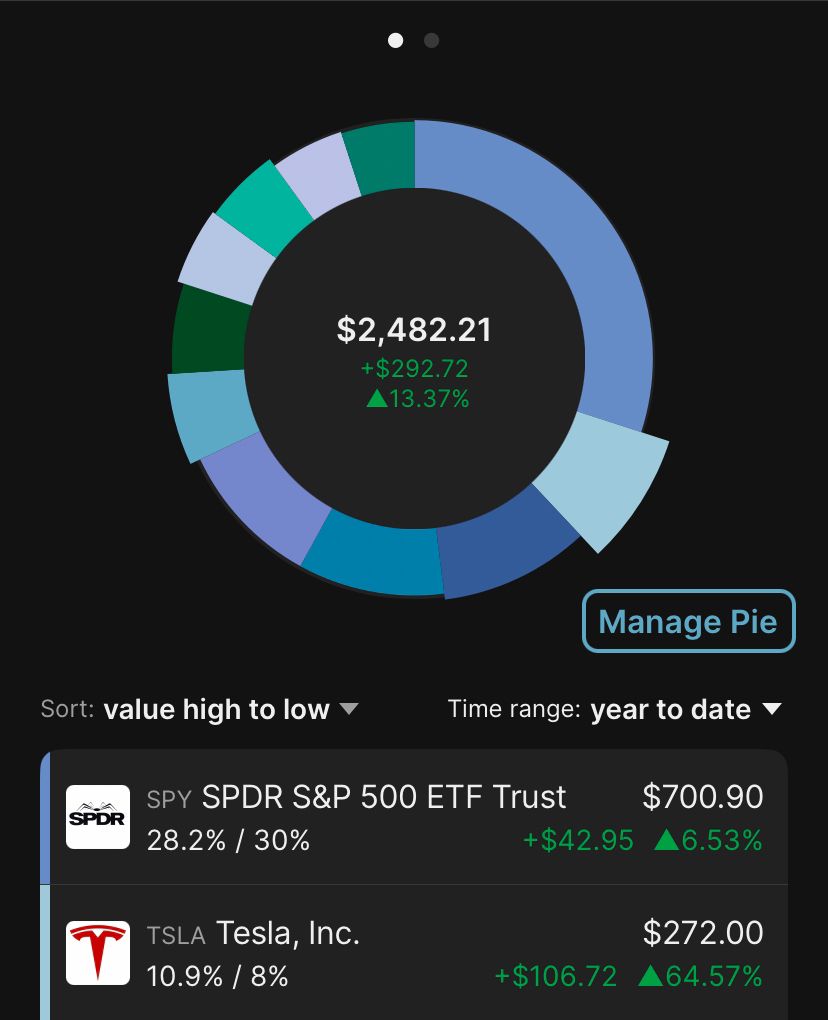

What sets M1 apart from others is their focus on portfolio investing. You cannot buy shares of stocks directly. You must always create a portfolio first, or pies in M1. Users can used managed pies or construct custom pies of individual stocks and ETFs. Custom pies let you select a set list of stocks and ETFs and assign percentages to them to determine their weight in your portfolio (total should equal 100%). Think of this like building your own mutual fund holding or index (such as S&P 500).

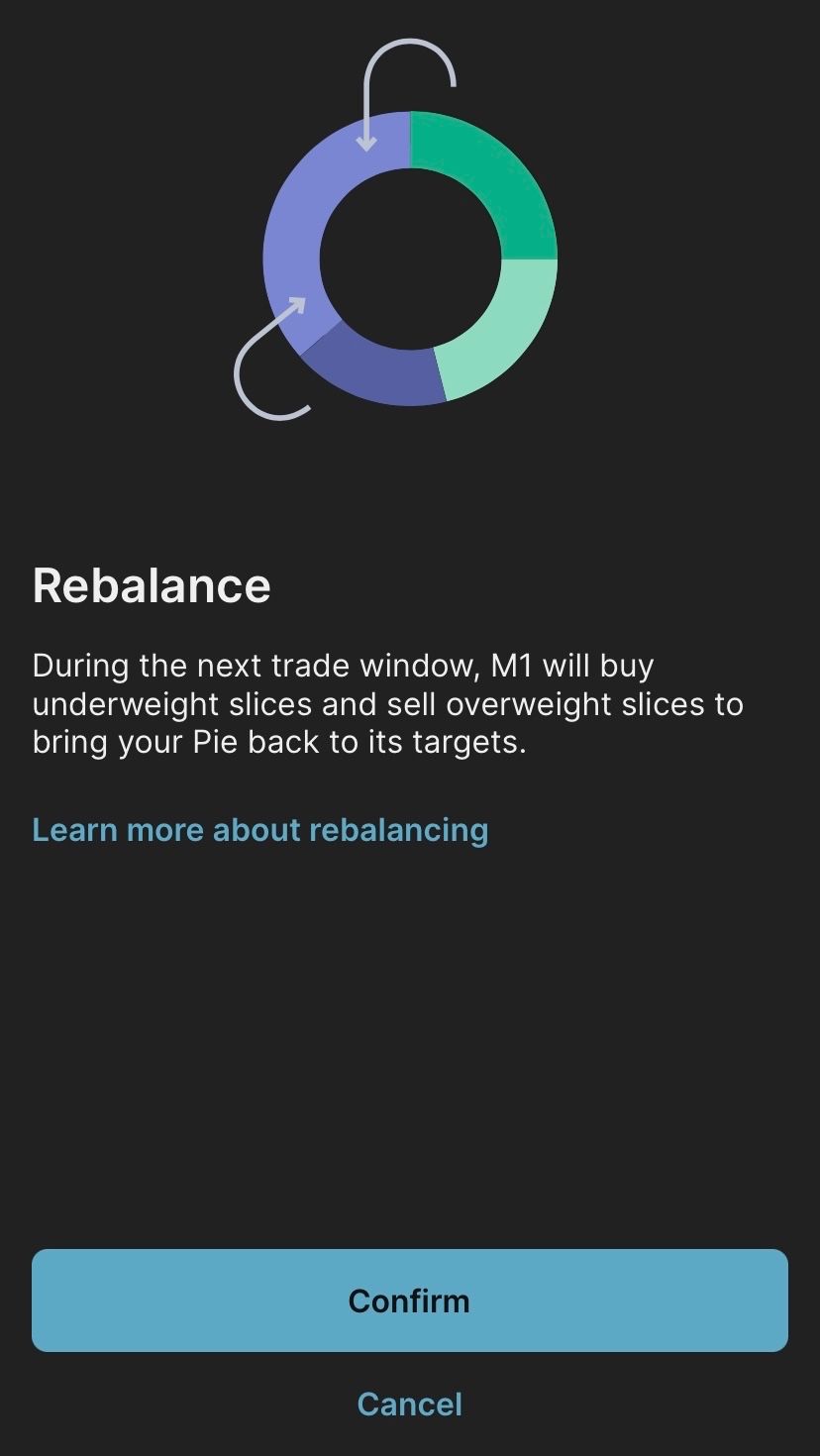

With pies, it is very clear when your portfolio is getting off track. If you see some of your holdings getting overweight, then you can utilize M1's rebalancing feature and it will automatically sell your overweight holdings and buy your underweight holdings to get your portfolio balance back to target.

M1 Plus Benefits

M1 provides a paid membership called M1 Plus which offers additional competitive benefits for investing and banking.

Some of the benefits worth highlighting include:

- Borrowing at 6.25% interest - This is incredibly cheap interest compared to most margin borrowing products (for example, Charles Schwab is offering borrowing at 12.58% interest as of 1/29/23).

- 3.30% APY on checking accounts - This is the highest APY I could find for a checking account and its almost on par with competitive high-yield savings accounts (HYSAs). This means you can get competitive interest returns without having to worry about withdrawal limits. If 3.30% APY is too low, M1 is also in the works of bringing a 4.50% APY HYSA.

- 1% cash back on M1 debit card - While I recommend using a 2% universal cash back card, there are some transactions that do not take credit cards but may allow debit. In these cases, the 1% cash back really stands out.

The Bad

Not Good For Traders

M1 is not a platform for traders. First off, you cannot explicitly trade shares of stocks you own. You can only change your holding weight and rebalance. Rebalancing uses M1's automated system to trade which brings your portfolio back to your target weighted holdings.

Secondly, intraday trading is basically non-existent and you cannot trade when you want. M1 has a morning trade window which starts at 9:30am ET and an afternoon trade window which starts at 3:30pm ET. The afternoon trade window is only available to M1 Plus members.

Finally, no options trading.

Majority Benefits Require M1 Plus

Most of M1's best benefits are locked behind their membership called M1 Plus. M1 Plus costs $125 a year (insert sweat emoji here) which is almost the cost of an Amazon Prime membership. The slightly good news is that it only takes about $3500 in their checking account to offset this cost given the boosted 3.30% APY.

The Recommendation

M1 is not for everyone. It is good for:

- Those who do not like trading and just want to invest - M1 is incredibly intuitive for long-term investors with its portfolio investing focus. It's lack of typical trading features is a blessing for those who would rather not be tempted to become a day trader and focus on the bigger picture.

- Those who like prefer online banking and like optimizing their finances - M1 is a one-stop shop for online banking and I would rate it as one of the best on the market because of its M1 Plus benefits. It is incredibly hard to beat 3.30% APY on a checking account and a 1% cash back debit card.

It is bad for:

- Those who want to trade

- Those who prefer banks with brick and mortar presence

- Those who prefer not to overcomplicate their finances (pretty hands-on to take advantage of M1 Plus benefits)

For me, I use M1 as my primary bank and my secondary brokerage. I like using M1 because of their cheap borrowing feature which I occasionally use for collateralizing big outflows (large purchases) without needing to sell assets. I put about a quarter of my assets in M1 to take advantage of margin loans throughout the year. Because of this, I also ended up using M1 as my primary bank since I was already onboard with M1 Plus.

I hope this review was useful! The goal of this is to make you aware that these products/services exist. Not everything I use is going to be for everyone. But if you are interested in M1, I have a referral link here. For new members, the M1 Plus membership has a free 3-month trial. M1 also currently has an account transfer promotion and the details are here. If you have any questions regarding M1, feel free to DM me on our Twitter account.

If you enjoyed this post, please consider subscribing to Pocket Finance Club to keep up with the latest financial news and tools to improve your pocket!