Maximizing Returns: Can You Earn Cash Back on Tax Payments?

As you are continuing to grow your income, you might start hitting a point where your default withholding is not enough and end up owing the IRS when taxes are due. For those new to making tax payments, it's not as scary as it may seem! It just means you made quite the gross income the past year and haven't paid enough taxes for your tax bracket. Congrats on reaching that milestone!

Now that you're faced with a tax bill, you may be pondering the best way to pay it. Options include directly through the IRS website or using tax preparation tools like TurboTax, which can handle the payment for you. But before you proceed, it's important to note that you can also use a credit card to pay your taxes. If you've been keeping up with my posts, you'll understand that anytime a credit card option is available, it opens up innovative ways to optimize your financial strategy.

Paying Taxes with Credit Card

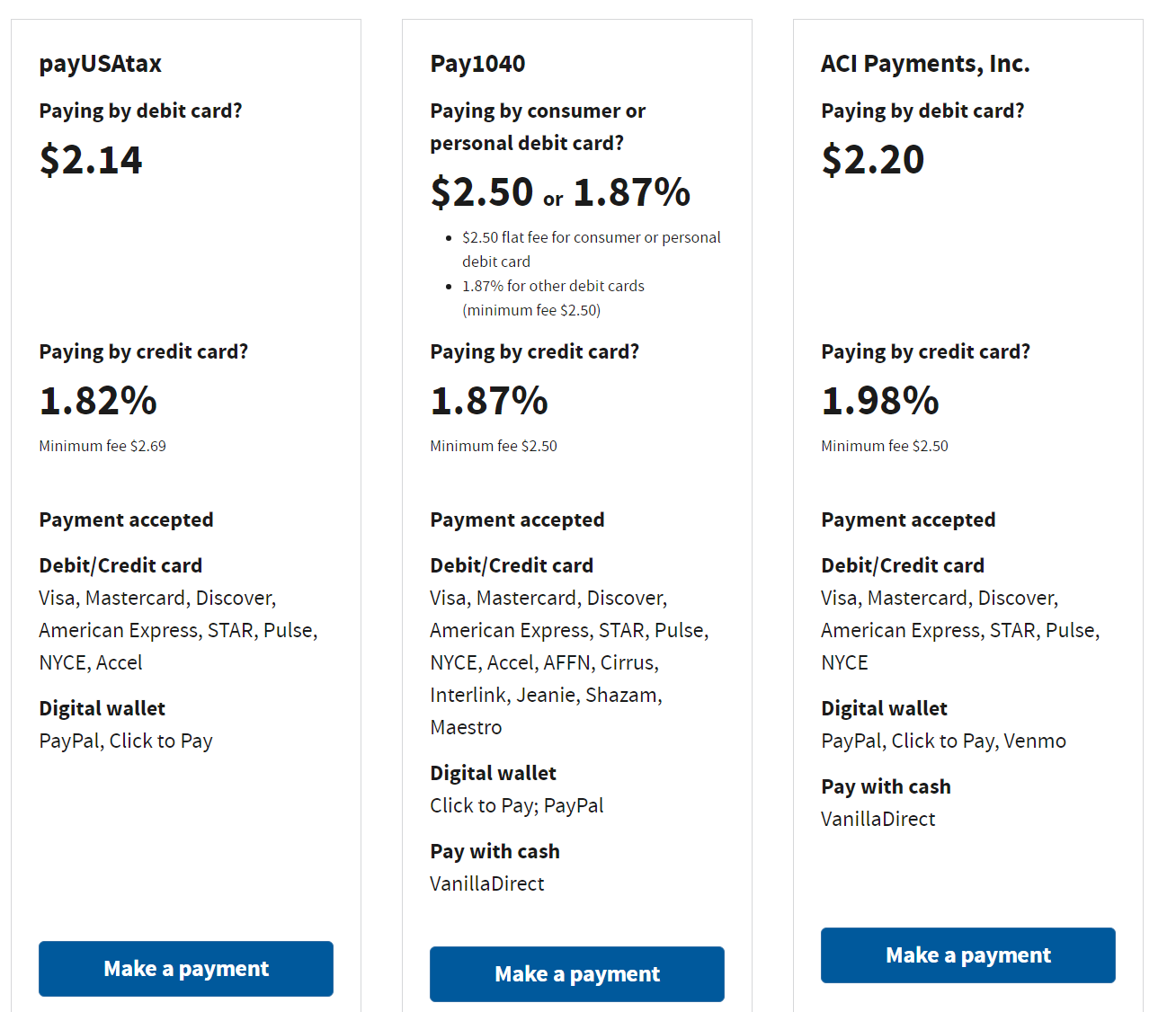

The IRS has partnered with third party payment processors to give you the option to use a credit card for payment.

For the most part, I have found very little differences between the payment providers so it probably makes most sense to go with the one with the cheapest fee. However, you'll notice the even the smallest fee is quite high (1.82%). With this kind of fee, you'll have to use an all-category 2% cash back card to be net positive. 0.18% net cash back might not be the most attractive reward for paying with a credit card but it's a start.

Paying Taxes to Get Welcome Bonus

If 0.18% cash back is not worth your while, you can instead leverage the tax payment as a way to hit large spend requirements for cards with significant welcome bonuses. For example, right now (as of 4/2/24) the Platinum Card for American Express has a welcome bonus of 150k points after spending $8,000 in 6 months. The card itself gives you the most bang for your buck when spending it on travel (5x pts, similar to 5% cash back), but spending $8,000 in 6 months on travel is not something easy to achieve. This is where utilizing some of the spend for taxes can come really handy since tax payments can be quite high. You'll typically see a lot of seasoned credit card holders take advantage of taxes to meet welcome bonus spending requirements. To complete the example above, if you were to put $8,000 on the Platinum Card for American Express, you'd look at a fee of $145.60, a welcome bonus of 150,000 points (valued at $900-$1500), and 8000 reward points (valued at $48-$80). This gives a net total of $800-$1430 value gained.

Paying Taxes with PayPal Cashback Mastercard

If you really want to keep tax payments and optimization simple, you can take advantage of the PayPal Cashback Mastercard which gives 3% cash back if you use it with PayPal checkout. If you check the payment processors above, you'll see that all 3 payment providers support PayPal. With that in play, you are now looking at a net 1.18% cash back return for tax payments (which is a lot more enticing).

Final Thoughts

Paying taxes is inevitable but there are ways to make it something a little easier to deal with. I definitely encourage to plan ahead of time on how you want to take on tax payments if you anticipate them. I personally like going the 3% cash back route with the PayPal Cashback Mastercard as it's very simple to manage. The PayPal Cashback Mastercard can also be used for other purposes too such as online shopping (for stores that support PayPal, which is usually most shops). As a reminder, taxes are due April 15th. Hoping tax filing goes smoothly for everyone!