Exploring Alternatives to Refinancing: The Option of Recasting Your Mortgage

Interest rates have been decreasing from their record highs, but they remain relatively high compared to pre-2022 levels. The average 30-year fixed mortgage rate is currently at 6.15%, which makes it challenging for new homeowners to reduce their monthly payments through refinancing as they likely secured a lower rate in the past. If you are a new homeowner impacted by this kind of situation, I am happy to share that there is another option that many homeowners may not be aware of that could help. It is called recasting.

What is Recasting?

Recasting is a process that allows homeowners to lower their monthly mortgage payments by making a lump sum payment towards their mortgage balance. Unlike refinancing, recasting does not require a credit check or appraisal and typically has lower closing costs.

When you recast, you are NOT getting a new loan like you would when you refinance. This means your term, rate and all other loan attributes stay the same. Recast simply applies your lump sum payment to your principal (lowering your loan amount) and recalculates your monthly due for mortgage based on your new loan amount. I put together a breakdown of the impact recasting has on a mortgage below.

| Factor | Recast |

|---|---|

| Loan balance | Goes down |

| Monthly payment | Goes down |

| Interest rate | Stays the same |

| Loan term | Stays the same |

Recast vs Making Extra Payments

Homeowners are generally aware of the option to make extra payments in order to pay off their mortgage quicker. So how does that compare to recasting? Well, let's first review how extra payments work.

When you make an extra payment, your remaining principal balance is reduced. This effectively lowers your interest charged for the remaining mortgage payments. After you have made extra payments, what you may notice is that your monthly due does NOT change. This can be confusing and make it seem like you are still paying the same amount of interest. But you are actually not. While the monthly due is the same, the ratio being paid to interest vs principal has changed.

Extra Payments Case Study

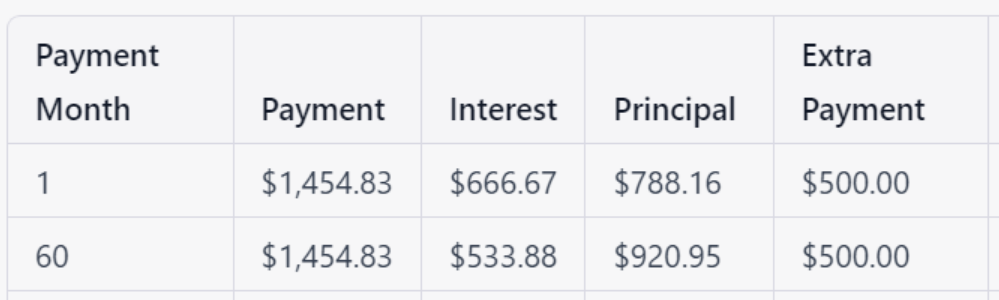

Let's take a look at how making extra payments of $500 per month can affect your mortgage payment schedule and the ratio of interest to principal over time.

Assuming you have a 30-year fixed-rate mortgage with an initial principal balance of $200,000, an interest rate of 4%, and a monthly payment of $954.83, here's what the payment schedule would look like over the life of the loan:

Without Extra Payments:

With Extra Payments:

As you can see in Month 60, the extra payments pay down the principal balance faster, which results in a lower interest charge on each subsequent payment (i.e. $533.88 instead of $545.70). In the early years of the loan, the interest portion of each payment is higher than the principal portion, but as you make extra payments, the ratio of interest to principal shifts in your favor as you pay more towards principal.

Which Approach is Better For Me

Both extra payments and recasting lead to similar outcomes—your remaining principal balance is reduced and you pay less interest. The main difference between the two is when you pay that interest:

- If you go for extra payments, your monthly due does NOT change, so you end up paying most of the reduced interest upfront similar to the original schedule.

- If you go for recasting, your monthly due does change, so you end up re-distributing the reduced interest across the remaining term of your loan.

If your goal is strictly to pay less interest over time, extra payments might be the preferred course of action. Recasting is a good option if you want to change your monthly due obligation on top of paying less interest, but of course, saving up for a recast will take time. The time spent waiting for the lump sum can lead towards more interest you end up paying since the mortgage balance remains unaffected until then. You might can offset this by putting that money in an interest bearing account however. All in all, it requires a bit of math to understand what works best for you. Please assess your own situation carefully and plan accordingly.

How Do I Recast?

Contact your loan officer or the company that services loan and ask them about their recast policy. There are three things to consider about a recast policy:

- What is the minimum lump sum amount to recast? This amount can be in the thousands or tens of thousands but depends on your loan size.

- What is the cooldown period for a recast? Some mortgage servicers have no cooldown period as long as any prior recast is fully processed and some mortgage servicers might make you wait a certain number of days.

- What is the cost to recast? Recast closing costs are just one fixed fee. This fee can be in the tens or low hundreds. Some mortgage servicers might not even have a fee (usually bigger lenders).

After you review the policy and if you still want to proceed, your loan officer or mortgage servicer will walk you through how to recast. From my personal experience with Wells Fargo, it involves them configuring your account for a recast and then making a one-time lump sump payment to your account which will then kick off the recast. This may differ per mortgage servicer though.

Final Thoughts

Recasting is not as common as refinancing, but it can be a great alternative for those who have savings that they would like to put towards reducing their overall mortgage pressure (monthly payment obligation). If you are already making extra payments, it is something definitely worth evaluating to see if you can get more out of recasting. If you are not making extra payments, it doesn't hurt to check what your recast policy is with your mortgage servicer and then do an assessment every now and then to see if it makes sense for you. Putting money to your mortgage will make it harder to access as equity is illiquid, so always make sure you think carefully about your situation before utilizing this tool. Please also consider how long you plan to keep your mortgage (are you going to sell in the next couple years, etc?) as both extra payments and recasting might not be as useful if you plan to sell in the near term.

Recasting has been one of my most favorite finds in the past couple years as a new homeowner. I am always surprised how overlooked it is as it can be useful. I hope this post was helpful for those who have not heard about recasting before or shed some more light to those who have heard of it but might not have had time to look into it.

As always--if you enjoyed reading this post, please consider subscribing to Pocket Finance Club to keep up with the latest financial news and tools to improve your pocket! We have a Twitter account and a Facebook page. For this topic, I am happy to take any DMs on Twitter for questions. Cheers.