Yotta Savings Account Rewards Ending: What You Need to Know

Yotta just sent out an email to users last week informing that Yotta's savings account rewards are ending. If you are not familiar with Yotta, it is a fintech company founded in 2019 that combines traditional savings with the excitement of a lottery. Instead of offering standard interest rates, Yotta provides users with weekly chances to win cash prizes based on the amount they save.

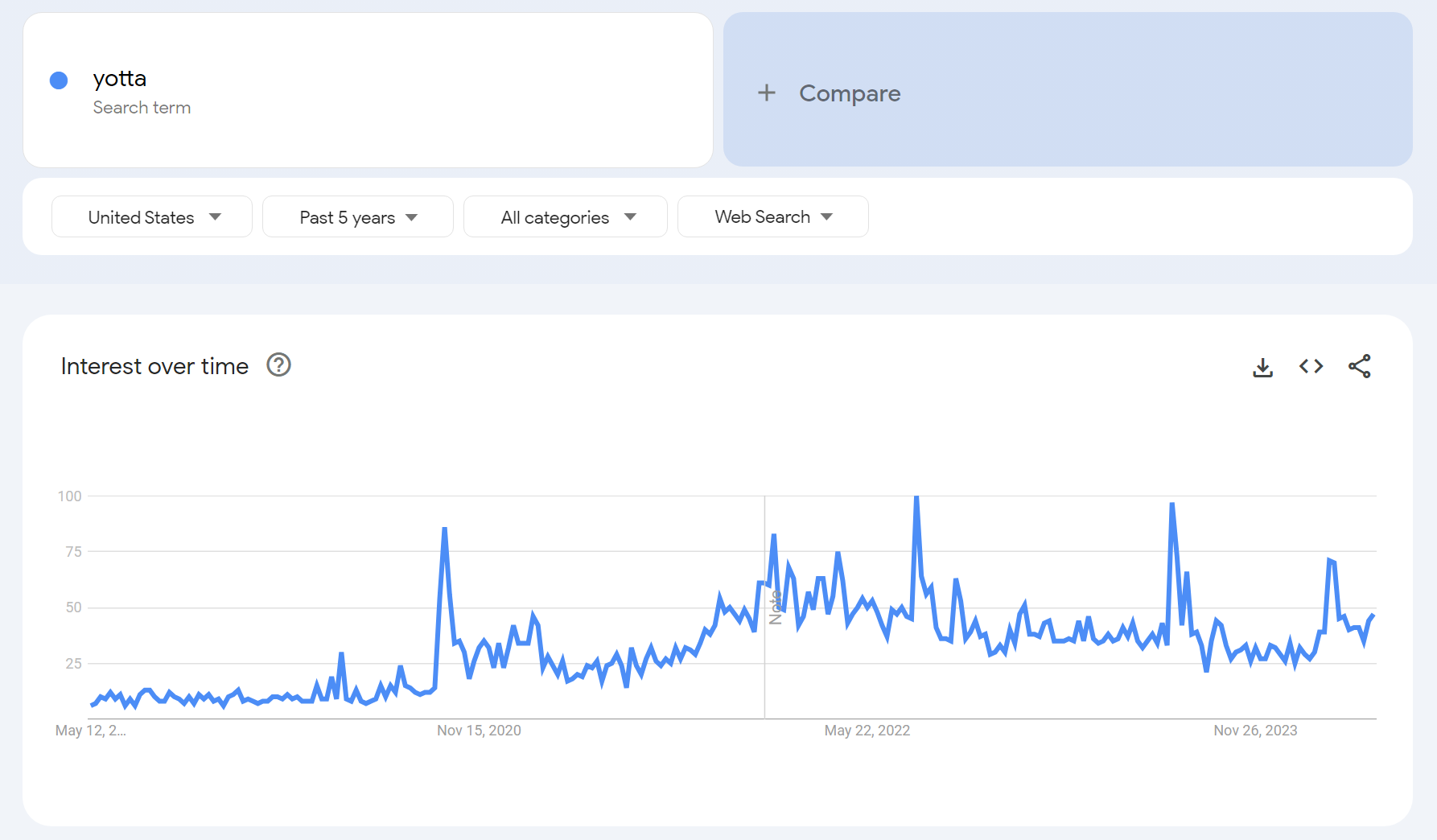

Yotta had been a revolutionary app that gamified savings and picked up steam during 2020.

They primarily focused on chance based earnings which worked really well in the beginning. However, over time, Yotta started diluting the rewards from their initial products (e.g. lowering lucky swipe changes and rewards, reducing prize value for partial lottery wins) and started pivoting towards casino-like games.

While this already made a number of users concerned about the direction of Yotta, Yotta proceeded to double down even further on this pivot and introduced virtual currencies such as YottaCash and tokens which become a proxy to play the lottery and games. This added even more complexity to the earnings structure making it challenging for users to track the return of investment.

Yotta Ends Savings Account Rewards

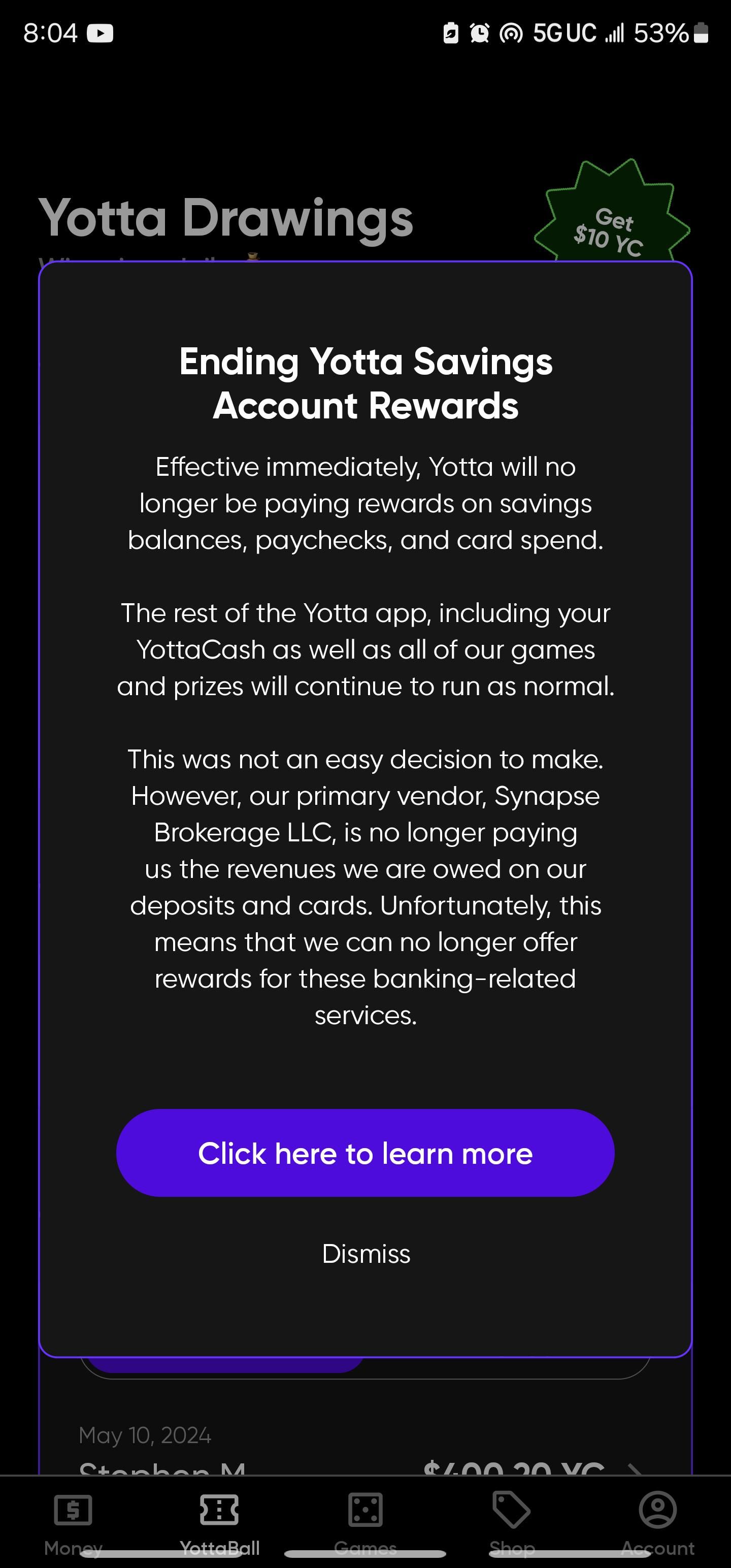

Yotta users in /r/yotta reported the abrupt messaging Yotta sent regarding their Yotta Savings Account Rewards last week.

Effective immediately, Yotta will no longer be paying rewards on savings balances, paychecks, and card spend.

The rest of the Yotta app, including your YottaCash as well as all of our games and prizes will continue to run as normal.

This was not an easy decision to make. However, our primary vendor, Synapse Brokerage LLC, is no longer paying us the revenues we are owed on our deposits and cards. Unfortunately, this means that we can no longer offer rewards for these banking-related services.

From the message, you will notice the callout to Synapse Brokerage LLC, which actually filed for bankruptcy recently. SoftBank's TabaPay was going to originally purchase the assets of troubled banking-as-a-service, but they recently backed out. Some highly suspect this being the likely cause of Yotta ending its rewards.

Is Your Money Safe?

Most likely. Deposits are held with Synapse Brokerage LLC member FDIC Program Banks. Funds held with Synapse Brokerage LLC member FDIC Program Banks are eligible for FDIC insurance up to $500,000. Visit https://synapsefi.com/list-of-program-banks for the full list of Program Banks.

How to Close Your Yotta Account

If you are interested in closing your Yotta account, you can do it from the app directly under Account Information. Make sure you transfer out your money first which can take 3-5 business days.

Final Thoughts

It's honestly a shame seeing Yotta getting to this point. I was an early user of Yotta back in its earlier days back when lucky swipes were a thing and my first Pocket Finance Club post was actually on Yotta. I even managed to get to platinum tier (10+ referrals) and earn well above the high yield savings rate of 3-4% at the time through their rewards system for a good year and a half. I’m not surprised that changes were necessary for sustainability, but when the rewards became so minimal that most high-yield savings accounts were a better option, it became difficult to justify keeping it. I closed my account shortly after YottaCash got introduced and I do not forsee myself signing back up with Yotta unless it somehow does a 180 and re-earns trust of its customers again. For now, I am sticking with Charles Schwab as my primary bank and M1 as my secondary.