Debt Hacking: The Art of Managing Debt

In the US, it is very common to find yourself in a situation where you might take on a form of debt, such as a mortgage, a personal loan, or a credit card, to perform a desirable transaction now versus later. The intent is always to pay back in the beginning, but times can get tough and a push to figure out how to mitigate the impact of the debt starts picking up especially with persistent debts that have a high interest rate. There are a couple strategies to managing debt: refinancing and debt consolidation. However, I do not think the strategies themselves give the optimal mental model for debt management and can limit the creativity of this space where every dollar counts. In this article, I will dive into the existing solutions to debt management and expand how to continue to iterate on optimizing the existing strategies.

Types of Debts and Borrowing Products

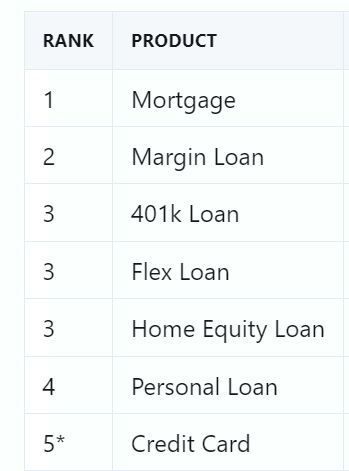

Before we go into debt management strategies, let's quickly debrief about debts since there are so many kinds. When you take on a debt, what you are doing is actually utilizing a borrowing product offered by an entity (typically a bank). There are several types of borrowing products, which includes both standard, regulated borrowing products (e.g. mortgage, personal loans) and questionably regulated borrowing products (e.g. hard money loans, shark loans). For the purpose of this article, I will only include standard, regulated borrowing products. These include the following:

In the above list, I have ranked the borrowing products based on their average interest rate fee. Mortgages are by far the most generous borrowing product. The reason why they have the best rates is because mortgages, specifically primary home mortgages, are meant incentivize home ownership and make the barrier to entry more affordable.

If you are getting a mortgage as an investor, the rate is higher than if you get it as a primary home owner.

At the bottom of the list, you will see credit cards, which is notoriously known as the worst kind of debt to have persist due to its extremely high interest rates. I put a star (*) however on its ranking because it can actually be one of the best debts when you consider some credit cards offer a 0% APR promotional period for up to 12 months. Given that, credit cards can actually can be temporarily considered one of the best borrowing products.

Debt Management Strategies

Strategy 1: Debt Consolidation

The most used strategy used for debt management is debt consolidation. The reason for this is because of the kind of debts the average person gets into. In a majority of cases, most people get into credit card debt since it's very accessible and typically more lenient on credit checks than other borrowing products. During a tough situation, it can be quite common to find oneself at a place and time where they cannot pay off the credit card balance in a timely manner due to the interest rate increasing the total balance more aggressively than it is being paid off.

Paying the minimum payment due does not stop the credit card issuers from charging you interest. In order to not get hit with interest, you must pay the statement balance due (NOTE: Statement balance is NOT the total balance. It is the charges due from the previous billing cycle. Total balance will include the previous and current cycle).

This is where debt consolidation comes into play. Debt consolidation is the act of taking multiple debts and consolidating that into a single loan. The idea here is you take a loan that has a more favorable rate and get cash for it. Then you use that cash to pay your debts with a higher interest rate (e.g. credit card debt). For debt consolidation, you want to use a borrowing product with a better rate to do this. So if you are consolidating credit card debt, you want to consider a personal loan at the minimum. If you take a look at the interest rate ranking board, you will see that the the rate improvement can be quite significant and can almost be a 100% improvement (half of the credit card interest rate). By reducing the impact of the interest rate on balances subject to interest, it will give a lot more breathing room to plan out how to fully tackle on the debt.

Strategy 2: Refinancing

Refinancing is another strategy borrowers use to improve their existing debt. Refinancing is the act of taking a new loan with better terms and using that to pay off your old loan. It's a similar theme of debt consolidation but the nuance is that refinancing refers to 1:1 exchanging and also typically includes terms and rate improvements.

Refinancing is a bit of a loaded term however so it's important to understand the concept vs the branded term. In the world of finance, if you want to refinance a loan, most loan providers provide this service but to them, it means you want them to provide a new and better loan for you in place of your existing loan with them. This typically incurs a refinancing fee. It is important to note that with less complex loans such as personal loans, there is quite a number of providers that do not charge an origination or application fee. So if for any reason you find yourself paying for refinancing a simple loan, it may be better to refinance through the means of getting a new loan from a separate provider and using that to pay off your existing loan with your old provider.

For more complex loans such as mortgages and auto loans, origination fees are a lot more common and so the refinancing fee is usually more favorable.

You don't always need a better rate to improve your debt obligations. For refinancing, sometimes expanding out the period of your loan can help alleviate the pressure of the loan. Keep in mind however, you will ultimately end up paying more interest that way over time.

The Key to Optimizing Debt

So now that you have a good understanding of some of the available strategies, it's important to understand that they are just starter solutions. How do you get to the next level from here? Well, let's talk about the fundamentals of the above strategies and how to apply that to potentially find other opportunities.

Exchanging Debt for Better Debt

The fundamental strategy of refinancing and debt consolidation is exchanging debt for better debt. The first thing you must do is understand the different kinds of debts and how they rank. From there, it's all about how to get from point A to point B in the debt ladder sooner than later to optimize the interest fees you pay.

For example, if you started with credit card debt, you can start exploring on how to transfer that debt into a personal loan debt. Similarly, if you started with personal loan debt, you can start exploring on how to transfer that debt into margin loan debt.

Once you have a good understanding of the compatibility of transfers of different debts, you can then build upon that as new opportunities arise to get you from one debt to another. With this mental model, you will have a better mastery of your own debt and can find better optimizations for it long-term.

Strategy 3: Credit Card Debt Hacking using Balance Transfer on Flex Loans

So what can you get out of the above mental model? Well, now when you see new borrowing products come to market or borrowing products changes in rules, you can take a moment to explore possibilities maybe come up with something interesting. Here is a strategy I crafted over the past year which involves utilizing credit card debt and balance transfers:

To give some background, I have been getting quite a few offers for flex loans over the past year including ones from Citigroup and Chase. Flex loans are loans you can take against your available credit limit. You effectively get cash in exchange for "credit card debt", but not your conventional kind. It's structured as a legitimate loan so you are billed per month with a payment plan and don't accrue credit card interest on the remaining amount due.

In parallel to this, I was also given some offers for balance transfers from the Fidelity Rewards Visa Signature Credit Card. The combination of these two offers got my brain thinking.

Flex loans are extremely interesting because it allows you to get hard cash in exchange for credit card debt. Normally, the methodology to optimize this loan is to move it to the next best borrowing product option; however, the interest rate on flex loans are already quite competitive and exchanging it into a margin loan provides very little improvement.

So what other options do we have? Well, remember that credit cards can be both the best and the worst form of credit card debt right? Now that we have credit card debt, we can transition it into better credit card debt with a balance transfer that offers a 0% APR promotional period. These balance transfer fees can range from 3-5% and are paid upfront. Compared to all the available borrowing product options however, this would be beat primary home mortgages with a rate of ~3-5% APR.

One example of using this strategy is if you had an existing personal loan that had 14% APR for a 1 year term. You can get a flex loan to pay off the personal loan and then do a balance transfer for 3-5% fee. If you kept the personal loan, you would have paid $774.45 in interest over the course of the year. With the balance transfer, you pay $500. This leads towards an overall savings of $274.45 with this strategy and that doesn't include other optimizations you can make such as using the cash you'd normally use to pay the personal loan to yield interest in a high yield savings account (HYSA) or treasuries.

While this strategy seems helpful, it is important to note that it is not that easy to execute. Here are some considerations:

- Flex loans are targeted and they will not always be available.

- Balance transfer offers are also targeted and not always available. You can go for a 0% balance transfer card but that comes at the cost of your credit score when you open a new card.

- At the end of the 0% APR period, it's basically a balloon payment. It's extremely critical you have all the money ready to pay off your balance so you don't get hit with the high credit card interest. This requires discipline to track your funds and the date its due.

Technically, yes. Some things to note though is cash advances are typically limited to a much smaller percentage of your available credit limit. They are also not structured as a loan, so if for any reason your balance transfer opportunity does not arrive or fails (due to any pre-requisites), then you will be in trouble with the high credit card interest rate kicking in on the credit card balance.

Final Thoughts

It is important to know all your options to managing your debt so you can set yourself up for getting back on the path of being debt free or fully in control of your own debt. The landscape of finance does change over time, so having the right mental model to evaluate opportunities to optimize and theory craft better ways to take advantage of systems will help give yourself an edge in your personal finance journey.